Areas of Interest

Corporate and Transactional Law

-

You’re not imagining things: contracts are getting longer, says Harvard Law professor

September 16, 2024

Corporate law expert Guhan Subramanian discussed his new book on deal-making obstacles and solutions at an event sponsored by Harvard Law’s Program on Negotiation.

-

After a decades-long career, Brian Price, clinical professor of law and founding director of Harvard Law School's Transactional Law Clinics, will retire this summer.

-

Holger Spamann, the Lawrence R. Grove Professor of Law at Harvard, has been named a fellow of the European Corporate Governance Institute (ECGI).

-

Ahead of the holiday travel season, Harvard Law graduate Ganesh Sitaraman argues in a new book that deregulating the airline industry has led to higher costs, less choice, and more misery for the flying public.

-

Harvard Law’s Transactional Law Clinics help community members build businesses and long-term financial security

September 6, 2023

Harvard Law’s Business and Non-Profit Clinic, Real Estate Clinic, Entertainment Law Clinic, and Community Enterprise Project make a difference for community members in Boston and beyond.

-

Corporate law and governance specialist Mariana Pargendler will join Harvard Law as professor of law

July 12, 2023

Mariana Pargendler, whose scholarship focuses on corporate law and corporate governance, will join the Harvard Law faculty in 2024.

-

Mergers and acquisition experts David Sorkin ’84 and Alan Klein ’84 to lead new course designed to provide students with additional hands-on corporate law experience.

-

Roberto Tallarita S.J.D. ’23, a lecturer on law and the associate director of the Program on Corporate Governance at Harvard Law School, has been named an assistant professor of law at Harvard.

-

Professor Rebecca Tushnet says that Disney’s claims of retaliation are strong and that, if the company prevails in the lower courts, the Supreme Court might choose to have the final word.

-

New faculty appointments

April 18, 2023

Harvard Law School expands the ranks of its faculty with four appointments.

-

Harvard Law expert J.S. Nelson says that Elon Musk and the tech industry risk gains when they engage in disreputable business practices.

-

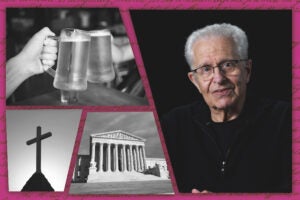

Laurence Tribe reflects on Larkin v. Grendel’s Den, 40 years later

December 7, 2022

In this installment of "Cases in Brief," Laurence Tribe reflects on the landmark decision involving a popular Harvard Square bar denied a liquor license by the church next door.

-

The Ames Game

November 14, 2022

At the 2022 Ames Moot Court Competition, two teams battled over Article III judicial power and climate change.

-

‘Misunderstanding how the world works’

November 9, 2022

Harvard Law Professor Mark Roe says that Wall Street short-termism has gotten a bad rap.

-

Articles by Harvard Law faculty and alumni among top ten corporate and securities articles of 2021

June 22, 2022

Articles by four Harvard Law faculty were selected in an annual poll of corporate and securities law professors as three of the ten best corporate and securities articles of 2021.

-

Jared Ellias, a specialist in the study of corporate bankruptcies, joins the Harvard Law faculty

June 9, 2022

Jared Ellias, a bankruptcy law expert and corporate governance scholar, is joining Harvard Law School as a professor of law.

-

Subramanian, Barzuza, other Harvard Law affiliates recognized by Corporate Practice Commentator

May 6, 2021

Articles by Harvard Law Professor Guhan Subramanian, Visiting Professor Michal Barzuza and several HLS alumni were named the Top Corporate and Securities Articles of 2020.

-

Helping the financially vulnerable find stability

March 25, 2021

Last year, Harvard Law Professor Howell Jackson and students in his FinTech class worked with a national nonprofit to help the United Parcel Service create an emergency savings program for 90,000 of its nonunion workers.

- 1

- 2