Imagine that you’re on the board of IBM, and the opportunity comes up to partner with the Bill & Melinda Gates Foundation to counter infant mortality. A no-brainer, right? Not necessarily, if you have shareholders to satisfy and a bottom line to maintain.

This is the kind of hypothetical that Harvard Law students regularly ponder in Hillary A. Sale’s course Corporate Boards and Governance, which brings in a range of high-profile visitors to share their experience with students.

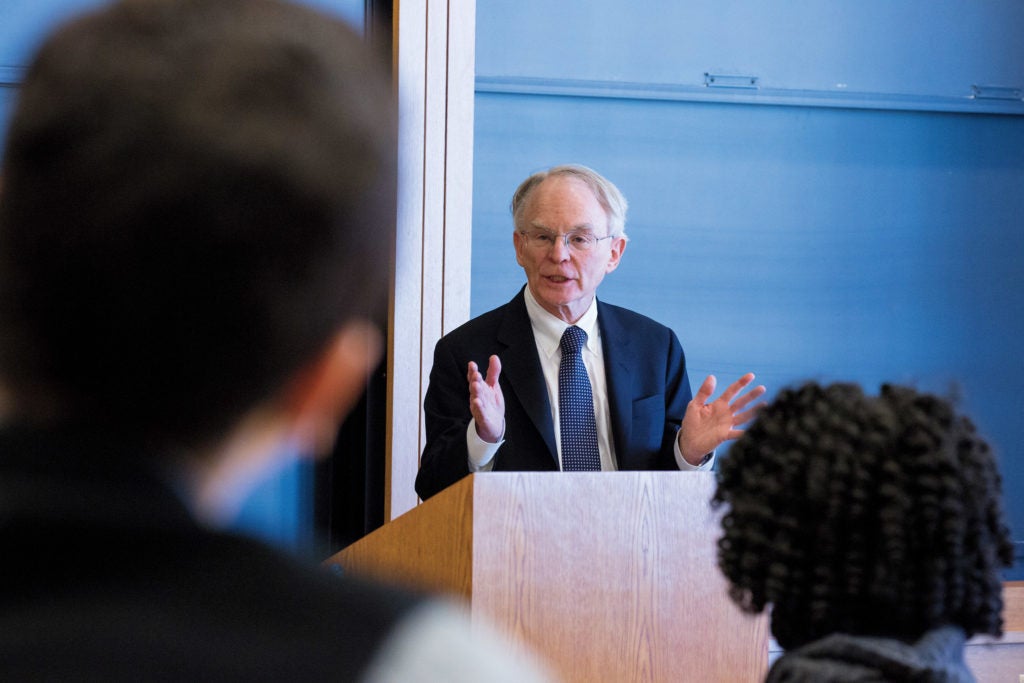

Sale ’93, a professor of law and of management at Washington University in St. Louis, is the Sullivan & Cromwell Visiting Professor of Law at HLS this spring. During a session of the class in early March, the students got expert guidance from H. Rodgin Cohen ’68, senior chair of Sullivan & Cromwell, and Melissa Sawyer, a partner in the firm. Both have done some top-level troubleshooting: Cohen brokered the deal that put Fannie Mae and Freddie Mac under federal conservatorship, and then counseled the biggest of Wall Street’s giants (Lehman Brothers, AIG, Goldman Sachs, and JPMorgan Chase among them) during the financial crisis of 2008.

Sawyer is a leading adviser on corporate governance, having worked on some of the notable mergers of recent years, including AT&T’s pending acquisition of Time Warner Inc. As she told the class, “A merger is the moment in a company’s life that really puts in stark relief the potential for conflict and cooperation between shareholders and management teams.”

That week, the class took on the charged atmosphere of a boardroom as the students, who’d studied the hypotheticals and submitted their answers in advance, engaged in a lively back-and-forth with the guest lecturers. “It’s where theory meets reality,” Sale said. Students are divided into teams and work together on projects, submit their reports, and then receive peer reviews in and out of the classroom. “The class is really about taking the academic research and seeing how it applies to board decision-making. The students read and discuss academic papers and carry that into team-based projects.” Other guest lecturers this spring have ranged from Debra Lee ’80 (CEO of BET Networks and on boards of Marriott and Twitter) to Deirdre Stanley ’89 (EVP and GC of Thomson Reuters) to Rebecca Onie ’03 (co-founder and CEO of Health Leads), to name just a few.

In the Gates Foundation hypothetical, the class ultimately decided in favor of the investment. But the reasoning went beyond simple conscience and more into practicality. Cohen began by asking, only half-jokingly, whether “corporate social responsibility” is an oxymoron. “There are a lot of social activists there [at the theoretical company], but why would a shareholder care about that? What’s in it for them?” Sawyer asked. One student replied that it’s about the corporate image, what it says about the management of employees and the way you structure your product.

Cohen confirmed that image is a strong concern. “There are three aspects of social responsibility that can be squared with a director’s legal duty to the shareholders,” he said. “The first is that your most valuable asset is your reputation — you lose that, you’re in deep trouble. The second is the appeal to millennials: You want to be seen as a company of choice. And if you’re viewed as not socially responsible, you’re going to restrict the bright young people that you’re able to attract. And the third is that there are now major funds set up to invest in socially responsible companies.” Still, Sawyer pointed out, every responsible investment doesn’t automatically get green-lighted. “Most of the Vanguards and BlackRocks of the world look at this on a case-by-case basis.”

The other hypothetical during the afternoon discussion focused on how the board should be structured as the current members transition out. This was a chance to explore what happens as a company changes its strategy — here into financial technology — and the larger questions of how to form a board, as well as what changes the board of a well-established company needs to make in the current climate.

The composition of a board has become a higher-profile issue lately, Cohen said. “In the last 15 years, we have seen an increasing focus on this people factor. With the fiascos at Enron and WorldCom, there were clearly major failures in leadership. They now want boards to be more sophisticated, more involved, more expert.” Sawyer also challenged the students to think about why they presumed a board would need frequent turnover. The hypothetical allowed the students to explore questions about how changes in a company’s strategy might play out in its board composition discussions.

The question of diversity came up as well. While most boards aim for gender and ethnic diversity, other issues have come into play — for instance, Sawyer pointed out that sexuality has only lately begun to factor in. Some boards are aiming for younger membership, which can lead to concerns about ageism. Sawyer said that Starbucks lately became the first major company to put a millennial on its board. “They wanted someone from the tech industry who had experience running a startup, and to get that, you have to go young.”

As Cohen pointed out, there are no definitive answers to any of these questions. But the interchange at Harvard proved enlightening on both sides. As he told the class: “The answers that you gave were clearly thoughtful. But what I would say most impressed me is how much you made me think as well.”