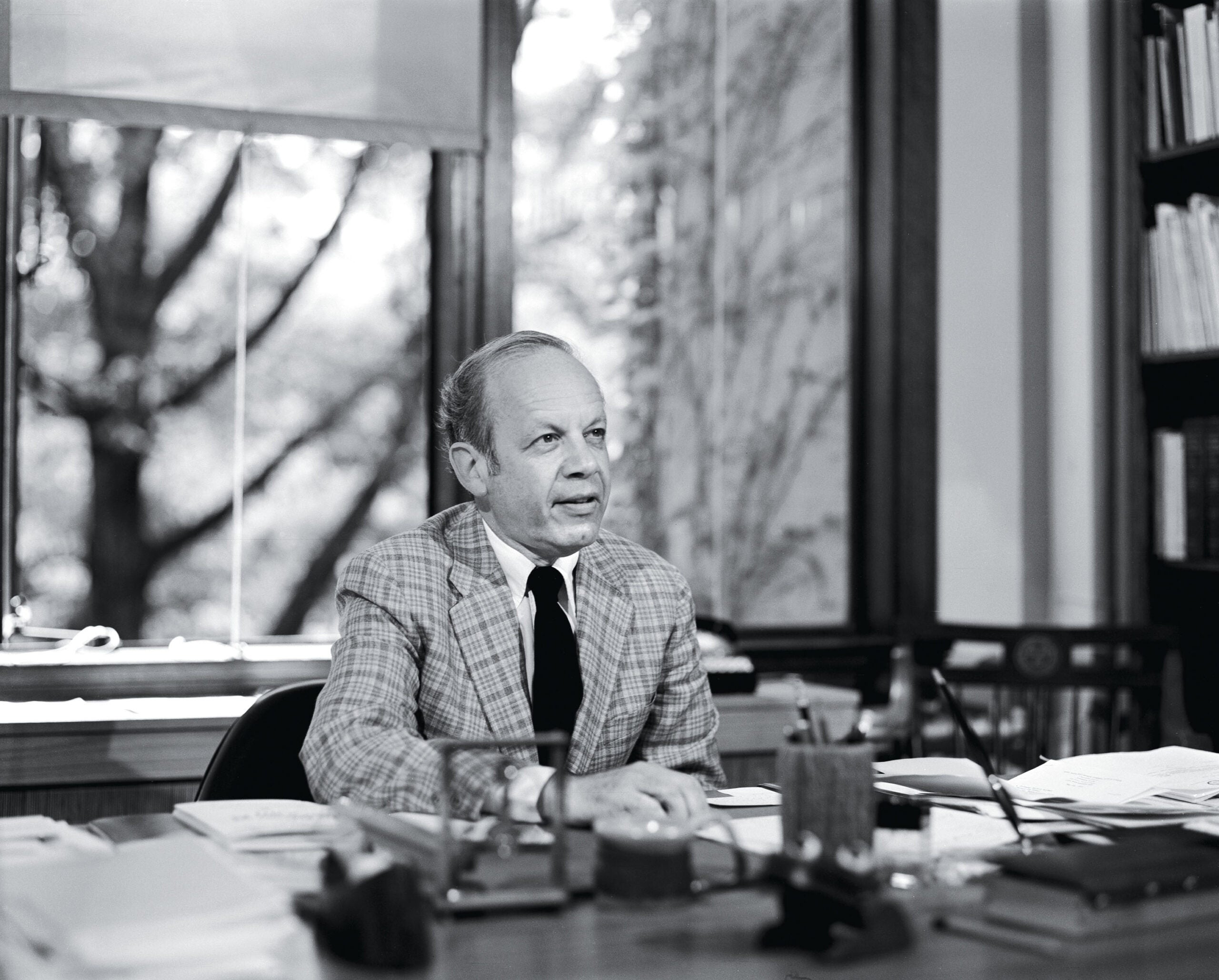

Bernard Wolfman, a renowned scholar of tax law and the Fessenden Professor of Law Emeritus at Harvard Law School, died on August 20, 2011. One of the preeminent tax professors in the United States, Wolfman clarified the world of tax law for generations of lawyers through his teaching and scholarship. He was also a leading expert in the ethics and rules of professional responsibility for lawyers.

“His contributions to tax and ethics, and his devoted teaching and mentoring of students and younger colleagues, will long endure as will his distinguished public interest advocacy and service to the profession,” wrote Harvard Law School Dean Martha Minow in a statement to the HLS community. “We will miss this wonderful man who gave so much to this community and beyond.”

Wolfman, whose principal teaching and scholarly interests were in the field of federal income taxation and the professional responsibility of tax practitioners, began his teaching career in 1963 at his alma mater, the University of Pennsylvania Law School. He served as University of Pennsylvania’s Gemmill Professor of Tax Law and Tax Policy, and he was dean of the law school from 1970 to 1975. A visiting professor at Harvard Law School in 1964, he joined the HLS faculty in 1976 as the Fessenden Professor of Law. In 2007, he became the Fessenden Professor Law, Emeritus. During his career, he also taught law as a visiting professor at New York University and the University of Michigan.

In a tribute in the Summer 2007 edition of the Harvard Law Bulletin, Howard Abrams ’80, one of Wolfman’s former students and currently a tax professor at Emory School of Law, wrote:

“Bernie was a magnificent teacher and a master of the Socratic method. While today’s students are less exposed to that style of teaching, for those of us who learned from it, it was a thrilling experience. … We learned by doing rather than by watching, and many of us learned not only the law but a love of teaching. The Socratic method can impose harsh demands, but Bernie was not at all harsh; on the contrary, he was kind and treated us kindly both inside and outside the classroom. For those of us who teach tax, Professor Wolfman is our ideal.”

A prolific writer, Wolfman wrote dozens of articles, essays and commentaries in law reviews and professional journals. His books include “Dissent Without Opinion: The Behavior of Justice William O. Douglas in Federal Tax Cases” (senior author), 1975; “Federal Income Taxation of Corporate Enterprise” (with Diane Ring, 5th edition, 2008); “Ethical Problems in Federal Tax Practice” (with Deborah Schenk and Diane Ring, 4th Edition, 2008), and “Standards of Tax Practice” (with J. Holden and K. Harris, 6th Edition, 2004).

Throughout his years as a professor, Wolfman remained active as a practitioner, consulting with law firms, large accounting firms and the government. In 2003, he served as senior adviser to the assistant attorney general for the Tax Division, U.S. Department of Justice. He was a consultant on tax policy with the U.S. Treasury Department from 1963 to 1968 and again from 1977 to 1980.

“[H]e has been deeply involved in the core of his professional responsibilities, creative reform of the national tax system, including pioneering work on the negative income tax,” wrote Louis B. Schwartz in a University of Pennsylvania Law Review article titled “Dean Bernard Wolfman: Heroes Need Not be Gods.”

Prior to his academic career, Wolfman practiced law for 15 years in Philadelphia in the firm of Wolf, Block, Schorr and Solis-Cohen, serving as the firm’s managing partner from 1961 to 1963.

Beginning in 1974, he served as a consultant for 20 years to the American Law Institute’s Federal Income Tax Project, where he made recommendations for structural legislative change. He also served as special consultant to Iran/Contra Independent Counsel Lawrence Walsh from 1987 to 1989.

He was a member of the Council of the A.B.A. Section of Taxation and council director of its committees on Corporate Taxation, Standards of Tax Practice, and Tax Policy and Simplification. He also served on the Council of the A.B.A. Section of Individual Rights and Responsibilities.

Wolfman was president of the Federal Tax Institute of New England and a fellow of the American Bar Foundation. He was also a fellow of the American College of Tax Counsel, serving for six years as its Regent from the First Circuit.

Born in 1924, Wolfman received his undergraduate and law degrees from the University of Pennsylvania, earning an A.B. in political science in 1946 and a J.D. in 1948.

He was the husband of Toni Wolfman; father of Jonathan, Brian, Dina Wolfman Baker, Jeffrey Braemer and David Braemer; brother of Lila Booth. He is survived by 10 grandchildren, nieces, nephews and cousins, and was preceded in death by his first wife Zelda.

In a speech to the American Bar Association’s Commission on Multidisciplinary Practice, Wolfman once said: “The law has been one of the loves of my life, not the only one, but a very important one. I believe deeply in the legal profession and the legal system for which it exists. As a young lawyer I heard Justice Frankfurter say to the group he was addressing that the legal profession is the noblest of all. That impressed me. I believe that it has sometimes been so, and I believe it can be so. It has been one of my professional goals and probably one of yours that it should be so.”

Click here to read the August 21 New York Times obituary.