Tag

Tax Law

-

Thomas J. Brennan ’01 to join Harvard Law faculty

June 25, 2014

Thomas J. Brennan ’01, a scholar specializing in tax and finance, will join the Harvard Law School faculty in July 2015 as a professor of…

-

How It All Adds Up

July 1, 2013

Stephanie Atwood ’13 started her 3L year several days early in a basement classroom of Wasserstein Hall in a new intensive “boot camp” on accounting and finance. In just three days, Atwood and 44 classmates learned a credit’s worth of previously foreign-sounding concepts such as internal rate of return and the cost of capital.

-

Stephen Shay: Reforming tax expenditures alone won’t fix the deficit

December 6, 2012

In recent debates over reducing the budget deficit, even politicians adamant about not raising taxes have been discussing the elimination of tax loopholes, or “tax expenditures.” We turned to Professor of Practice Stephen Shay, and asked the former deputy assistant secretary in the U.S. Treasury: What are tax expenditures, and should they be repealed as a means to lower tax rates, reduce the deficit or both?

-

Roe in Project Syndicate: Tobin Trouble

February 24, 2012

In a Feb. 20 opinion piece for the online journal Project Syndicate, Harvard Law School Professor Mark Roe ’75 addresses European leaders’ support for imposing a “Tobin tax” on financial transactions.

-

Vivek Wadhwa: On jobs, Obama needs to be a radical

September 8, 2011

The only way we can keep Americans fully employed and maintain our global lead is by constantly improving their productivity and skills, writes Vivek Wadhwa, a senior research associate for the Labor and Worklife Program at Harvard Law School, in an op-ed in today's Washington Post. In his op-ed, "On jobs, Obama needs to be a radical," published on the eve on the president's address to the nation, Wadhwa writes that American companies must be provided with the incentives to invest in their workers as they used to.

-

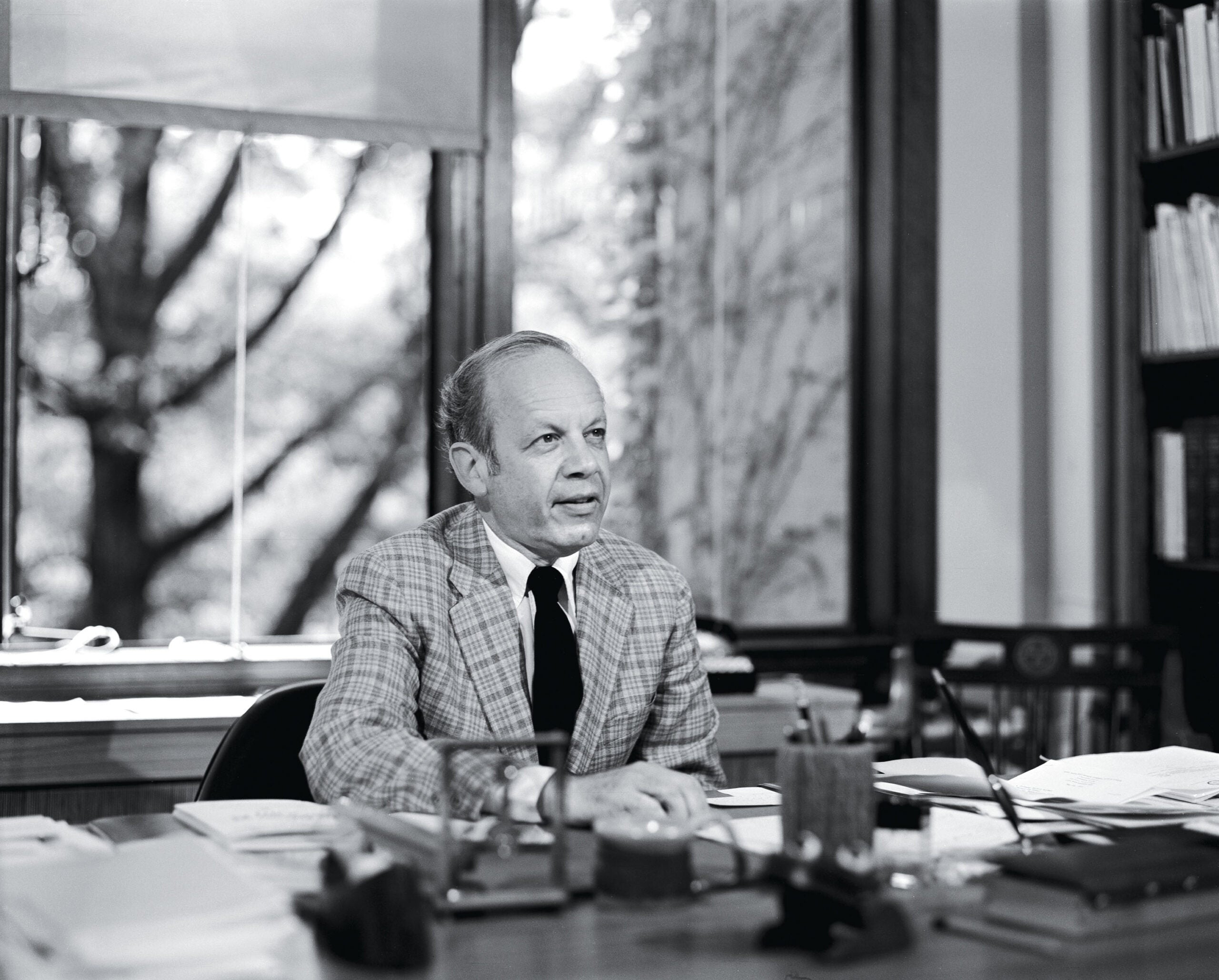

Bernard Wolfman, 1924 – 2011: Magnificent teacher, beloved mentor and renowned scholar

August 22, 2011

Bernard Wolfman, a renowned scholar of tax law and the Fessenden Professor of Law Emeritus at Harvard Law School, died on August 20, 2011. One of the preeminent tax professors in the United States, Wolfman clarified the world of tax law for generations of lawyers through his teaching and scholarship. He was also a leading expert in the ethics and rules of professional responsibility for lawyers.

-

Mihir A. Desai, who currently serves as the Mizuho Financial Group Professor of Finance, the Senior Associate Dean for Planning and University Affairs, and the Chair of Doctoral Programs at Harvard Business School, has accepted a joint appointment to the faculty of Harvard Law School as a tenured Professor of Law.

-

A Tax—Not an Attack—on Families

July 1, 2010

In recent years, political discourse has often focused on the idea of family values. Another contentious political issue has been the inheritance tax. The two topics commingle in a recent paper by Anne Alstott, in which she considers whether the inheritance tax is compatible with family values.

-

Congressional Oversight Panel, led by Warren, held hearing with Geithner

September 9, 2009

The Congressional Oversight Panel, led by Harvard Law School Professor Elizabeth Warren, held a hearing with Treasury Secretary Timothy Geithner yesterday.

-

John C. Coates, the John F. Cogan, Jr. Professor of Law and Economics at HLS, issued a set of recommended reforms regarding the regulation of mutual funds, in June. The recommendations were made to the Committee on Capital Markets Regulation, an independent and nonpartisan organization whose research is aimed at improving financial regulations and practices.

-

In a follow up to their May 21, 2009, Financial Times’ op-ed, Harvard Law School Professor Mark Roe ’75 and New York University School of Law Professor Michael Levine discuss how to make a petrol tax politically viable. Their op-ed appeared in the July 7, 2009 edition of the Financial Times.

-

In an op-ed, “Delayed petrol tax beats CAFE plan,” that appeared in the May 21, 2009, edition of The Financial Times, Harvard Law School Professor Mark Roe ’75 and Michael Levine of New York University School of Law discuss the need for a petrol tax in order to make the Obama Administration’s automotive goals work well.

-

On April 24, Harvard Law School Professor Emeritus Bernard Wolfman, a leading tax law expert, spoke on “Ethical Problems in Tax Practice” at the Sixth Annual Institute on Tax Aspects of Mergers and Acquisitions. The event, held at the offices of the New York City Bar, was presented by the New York City Bar in conjunction with the Center for the Study of Mergers and Acquisitions of Pennsylvania State University’s Dickinson School of Law.

-

Warren in the Boston Globe: Keeping tabs on the bailout

April 13, 2009

The following interview with Harvard Law School Professor Elizabeth Warren appeared in the April 12, 2009, edition of the Boston Globe. Newsweek magazine also recently profiled Warren and her work in an article, “The Debt Crusader,” that will appear in the magazine’s April 20, 2009, issue.

-

Bebchuk in Washington Post: A fix for Geithner’s plan

March 30, 2009

The following op-ed by Harvard Law School Professor Lucian Bebchuk LL.M. ’80 S.J.D. ’84, “A fix for Geithner’s plan,” appeared in the March 31, 2009, edition of the Washington Post.

-

HLS Professor Anne Alstott on tax and social welfare policy

February 18, 2009

Professor Anne L. Alstott, a tax and social welfare policy expert, joined the faculty in 2008 as the Manley O. Hudson Professor of Law and Director of the Fund for Tax and Fiscal Policy Research.

-

Tax Policy, Writ Large

September 10, 2008

In a new book, Professor Louis Kaplow '81 "steps back and considers the relationships among the parts." The book -- “The Theory of Taxation and Public Economics” (Princeton 2008) -- stands to secure him a place in the firmament of public economists and scholars in public finance.

-

Anne Alstott, an expert on federal income taxation, corporate taxation and tax policy as well as on social welfare policy, family policy, and feminism and economic justice, will join the Harvard Law School faculty as a tenured professor, Dean Elena Kagan '86 announced today.