If leaders had listened to Elizabeth Warren years ago, she wouldn’t have the job she has now.

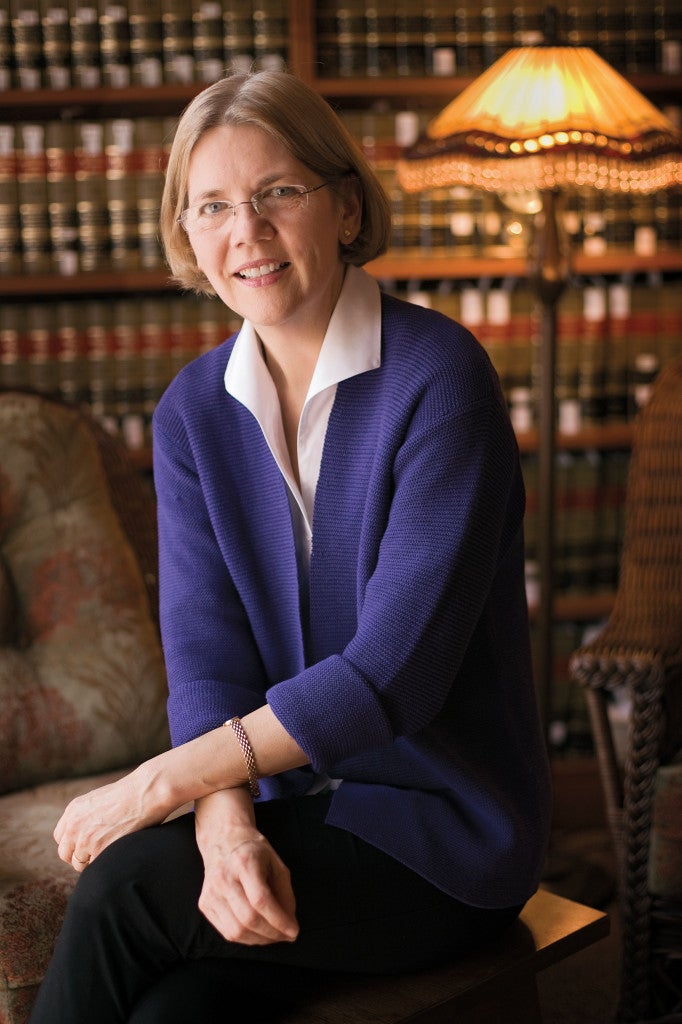

It’s a Monday morning in early March, and Professor Elizabeth Warren’s latest interview on NPR is no sooner over than the phone in her Hauser office begins ringing. Fans call with messages of gratitude, and she is deluged by e-mails.

It’s like this all the time, ever since Warren—the credit-card Cassandra and champion of average American families, who for years warned that an economic collapse was imminent—was appointed in November to monitor the $700 billion federal bailout known as TARP (the Troubled Asset Relief Program). As chairwoman of the Congressional Oversight Panel, Warren lost no time expressing outrage that billions had already been handed out with no restrictions on the financial institutions receiving them. She took her plain-spoken message to newspapers, TV, radio and her own blog, tirelessly explaining to taxpayers how their money was being used—and misused—in the massive effort to rescue failing financial institutions and, by extension, the nation’s economy. Her calm but righteous indignation struck a chord with much of the nation. Facebook has a Warren fan site, and she can’t walk across the HLS campus or through downtown Washington, D.C., without someone stopping her to thank her. It’s like a great outpouring of relief that, finally, someone sensible is at the helm, making sure the supposed fix for the current disaster doesn’t make things worse.

“I get heartfelt thanks from all kinds of people,” says Warren, who these days is bouncing between the nation’s capital and Cambridge, where she continues to teach her yearlong seminar, Empirical Analysis of Law. “Today I heard from a waitress in Georgia who has lost her job and is trying to figure out how her local bank can change the terms on her credit card, and I heard from a physicist at a major research university who wants to explain a better theory of financial stress tests.”

Since the five-member oversight panel has no veto power on how the TARP money is spent, Warren is primarily a watchdog trying to make sure decision-makers and the public pay attention. “Part of my job is to make sense of all that I hear, and to retell it in a forceful way so that the decision-makers at Treasury can hear it.” She pauses and adds, “At least that’s how I see it.”

She’ll use her bully pulpit in any way she can. Tomorrow, she’s heading back to Washington to stand alongside Sens. Dick Durbin, D-Ill., and Charles E. Schumer ’74, D-N.Y., as they announce proposed legislation to create a Financial Product Safety Commission to ensure that financial products sold to consumers are fair and transparent. The commission, modeled after the Consumer Product Safety Commission, was Warren’s idea; just as unsafe toys and toasters are illegal, she believes unsafe financial products should be, too, because they’re not only dangerous to the individual buyers, they can also create a massive domino effect that leads to widespread economic chaos. “If there had been a Financial Product Safety Commission in place 10 years ago, the current financial crisis would have been averted,” she says. (As the Bulletin went to press, the Obama administration was said to be studying proposals for such a commission.)

How bad are things? “We’re in a lot of trouble, and I’m worried. I’m very worried,” says Warren. “We haven’t found the bottom yet; we haven’t gotten honest about the numbers. And until we do, we can’t start rebuilding. We’re continuing to put money into financial institutions without a clear strategy for how this will solve our problem.” Half the TARP money is already gone “without much to show for it,” she says, with a sigh, and she wants to make sure the rest isn’t doled out the same way.

“I’m trying so hard to get ahead of the curve on this,” she says. “When we did the valuation report, the one that came out [in February], it showed that $78 billion disappeared on the day the transaction took effect, and of course, tens of billions have disappeared since then in market value. … We did [the report] quickly—we were out with it within a month of the time the money had gone out the door—but it was gone. What I’m desperately trying to do now is get ahead of the next release of funds, to talk about the structure of the deal and to press Treasury harder to explain its overall strategy.”

Of course, not everyone is a fan. Warren’s detractors say she’s soft on irresponsible consumers who have no one but themselves to blame for their debt. Even her own brothers in Oklahoma, to whom she remains very close, challenge some of her suggestions. She uses them as her sounding board as she tries out how best to get across her message that financial rules must be rewritten to be fairer to consumers. And the situation could not be more urgent, she believes.

“What we collectively decide about how to bail out our economy, how to pull our economy out of a ditch and what rules we put in place to make sure this problem does not happen again, will shape our country for the next 50 years,” she says. “This is it. It’s going to happen in the next six months. So the decisions we make here are decisions about our collective futures for the rest of my life, the rest of my children’s lives and into the lives of my grandchildren.” She leans forward, as if propelled by the energy of her convictions. “It is critical,” she says, somberly, “that the American people, and not just their financial institutions, be represented at the negotiating table.”

She sits back up, suddenly, and smiles. “So! This COP [Congressional Oversight Panel] provides an opportunity to talk with both the administration making these decisions and the public. There are very few precedents for this kind of thing in history. It’s a wonderful thing.” The sunshine of public attention hasn’t often shone on the complex workings of the government’s financial oversight boards, she notes. “The Treasury Department exists and functions largely independent of public input.” She laughs, and adds, “Ordinarily, its Web site doesn’t get many hits. By and large, the work of Treasury has been the work of specialists. But today they are playing with the future of the world. And Americans across this country recognize that. They want to be heard.”

As Warren speaks, in a vaguely Southern accent, she smiles, laughs, put her hands up on top of her head to ponder, listens carefully when someone else talks. She’s warm and approachable, like a friendly and wise neighbor whose advice you respect. Her two best-selling books, co-written with her daughter Amelia Warren Tyagi, are aimed at helping American families stay afloat financially and are written in sentences that she describes as “Oklahoma flat” fancy language is often the refuge of poor ideas, she believes. The decency she exudes—the sense, to the average American, that she’s one of us—isn’t feigned.

“I’m still very connected to my family, to the world I grew up in,” says Warren. “I understand what it means to be afraid that you can’t pay a doctor’s bill.” Her voice drops. “Or to have to make the choice between buying a band uniform for a seventh-grader and making the insurance payment on time. That will never leave me. It was how I lived until I was well into my adult years. And I understand the basic, hardworking goodness of people whose ambitions are to do right by their kids and make it through retirement without being a burden to others.”

The country’s eyes are upon her, and everyone is counting on her. And she knows it.

“Here’s what haunts my dreams,” she says, looking outside her office window. “I wake up, at 5 in the morning, fearing that it’s a year from now, and things have not gone well, and I missed something. Maybe I failed to identify the critical link that we should have looked at, or failed to say something urgently enough to someone in power, or failed to explain with enough clarity that the American people could understand why they needed to support something or needed to attack it. I worry that a year from now I will understand how I fell short. And all I can do now is my best, but I don’t know if I’ll get it right. I will try.

“It is a huge responsibility; I am deeply sobered by the responsibility,” she continues. “There’s nothing else I want out of this except to get it right. I’m not looking for another job, not looking for a promotion, not looking to run for office, not looking for some kind of personal glory for this. I just want to help us get it right. In the face of high risk, many people become cautious. Others say, it’s all on the line, so give it everything you’ve got. I’m hard-wired to be in the latter group.”