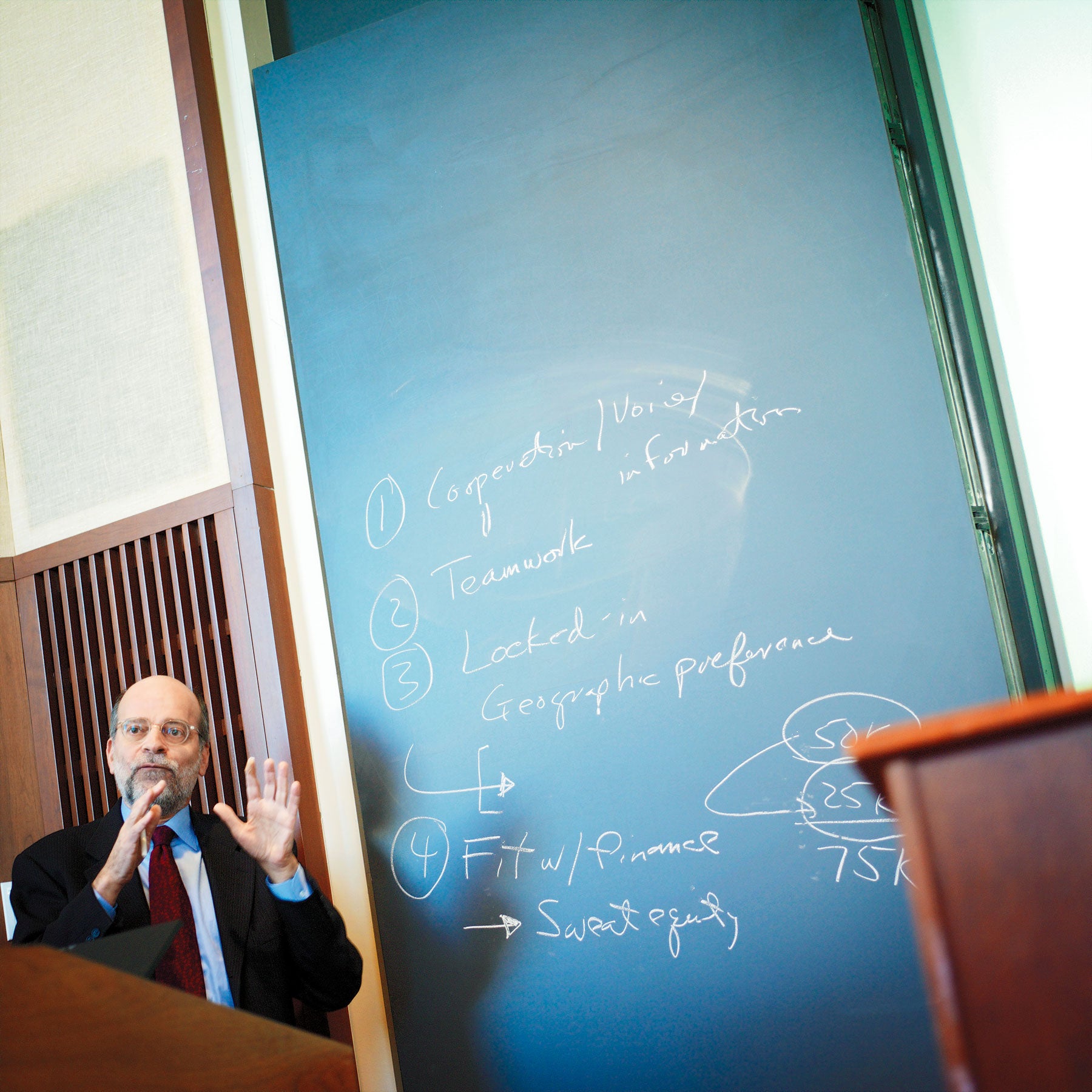

[pull-content content=”Professor Mark Roe’s course on corporate governance offers students the latest scholarship in the field, much of which is produced by HLS faculty.” float=”center”]

As globalization transforms business, some corporate law experts are engaging a world of issues.

In the past five years, Harvard Law School’s corporate law scholars have accounted for nearly a third of the top 10 articles on corporate law and securities published nationwide, as ranked by an annual poll of corporate law professors around the country.

The honor reflects what faculty members are describing as an especially prolific and influential moment for corporate law at the school. “Harvard Law School has absolutely the finest business law faculty in the world right now—scholars who are engaged in pathbreaking scholarship and innovative teaching, who are also making significant contributions at the highest levels of policy-making,” says Dean Elena Kagan ’86.

“Globalization is changing American corporate and legal culture,” Kagan adds, “and all of our faculty experts, in their own ways, are at the forefront of understanding important aspects of these changes.”

From Sarbanes-Oxley reform to executive compensation in companies listed on the Tokyo Stock Exchange, the HLS corporate faculty is looking at myriad ramifications of an increasingly competitive global economy and how corporations are—and should be—governed. Professors Lucian Bebchuk LL.M. ’80 S.J.D. ’84 and Hal Scott have made headlines recently, but Harvard’s other corporate scholars have been just as busy, often in collaboration with each other.

Taking stock

Last year, the University of Iowa College of Law and its Journal of Corporation Law published a volume of scholarly articles marking the 20th anniversary of the publication of the treatise “Corporate Law” by former HLS Dean Robert Clark ’72.

“Bob Clark’s pathbreaking treatise is arguably the single most influential work of scholarship in corporate law in the past quarter century,” says his colleague Reinier Kraakman, a principal editor of “The Anatomy of Corporate Law: A Comparative and Functional Approach” (Oxford University Press, 2004).

Looking back at the 20 years since he first published the treatise, Professor Clark points to several trends that have emerged. The first, he says, has been the rich development of doctrines relating to hostile takeovers and defenses against them, particularly in Delaware.

A second major change has been the rise of limited liability companies and other business forms that are more attractive to owners of closely held businesses than the traditional close corporation, says Clark. Another trend, he notes, “is the federalization of much of corporate law litigation,” including the rise of securities fraud class actions, and the growing role of the Securities and Exchange Commission and the Department of Justice in addressing major accounting scandals.

Other trends Clark points to include a sharp rise in regulatory concern about executive compensation, and the wave of corporate governance changes resulting from the Sarbanes-Oxley Act of 2002 and related phenomena like new listing requirements and the rise of corporate governance rating agencies. “My perception,” he wrote recently, “based in part on service as a director of several large public companies, is that for about three years, these changes dwarfed takeover and M&A-related issues in terms of the time, money and worry demanded of corporate managements and boards.”

Looking at possible Sarbanes-Oxley reforms, Clark cautions legislators to include explicit provisions that authorize and mandate serious empirical study of the effects of particular regulatory changes.

Furthermore, Clark says, in the rush to enact new safeguards in the post-Enron environment, a distinction should be made between the governance of for-profit and nonprofit corporations. Rules appropriate for the for-profit world may not be needed in the nonprofit world, he recently argued at a symposium sponsored by the law school and Harvard University’s Hauser Center for Nonprofit Organizations. “In paradigmatic nonprofit corporations, the moral systems are often more important and potentially more effective, and the legal system is often less important and less potentially effective, than in the case of for-profit corporations,” he says.

Clark taught an oversubscribed course on mergers, acquisitions and split-ups this fall with Delaware Court of Chancery Vice Chancellor Leo E. Strine Jr. One of the highlights: a session analyzing the failed attempt by investor Carl Icahn to win control of Time Warner AOL in 2005. In an unusual corporate “postgame wrap-up,” Icahn’s adviser during the bid, Lazard CEO Bruce Wasserstein ’70, and his rival during the drama, Time Warner CEO Richard Parsons, traded questions, answers and observations in front of an overflow crowd of students and faculty.

Mergers, friendly or otherwise, have been a particular interest of Professor John Coates, an expert on takeover defenses who, with Bebchuk and Professor Guhan Subramanian ’98, has examined the anti-takeover effects of staggered boards of directors. Recently, Coates and Kraakman examined the role played by a CEO’s age, tenure and share ownership in explaining why the CEO’s company is sold.

The health of U.S. capital markets

“I am studying the operation of the [National Association of Securities Dealers] markup rule in the equities market using proprietary data provided to me by the NASD,” reports Professor Allen Ferrell ’95, who has been serving on the board of economic advisers and as an academic fellow at the association.

Ferrell played a major role in the work of the Committee on Capital Markets Regulation and was the primary author of the shareholder rights portion of the committee’s report. (Kraakman, too, lent his expertise to the committee’s work.)

Ferrell has also written three forthcoming articles: one on “structured products” (in a Brookings Institution volume on new financial services), one on cross-border stock exchange mergers (in a volume by Euromoney), and an article on the effects of disclosure requirements on stock market efficiency (in the Journal of Legal Studies).

Meanwhile, focusing on what he calls “the divide between public and private companies in the aftermath of SOX” and, more broadly, on global competition between public and private capital markets, Subramanian has published papers examining buyouts by controlling shareholders, in The Yale Law Journal and the Journal of Legal Studies. “They are no longer interested in subjecting themselves to SOX’s regulatory requirements for the benefit of a public minority float,” he says. One of his findings: “Freeze-outs” of minority shareholders in companies that are going private have more than doubled since 2001.

Subramanian has also undertaken an empirical study of private equity deal-making and is looking at “club” deals—in which private equity firms team up to do massive buyouts of public companies—and “go shop” provisions, a contractual innovation in private equity leveraged buyouts that potentially allows private equity firms to buy out public companies at lower prices.

Regulatory issues, seen from abroad

Professor Howell Jackson ’82 has been dealing with global regulatory issues from overseas. On sabbatical in England this year, he recently collaborated with S.J.D. candidate Stavros Gkantinis on a paper comparing market oversight in eight jurisdictions. He has also been looking at the regulatory conflicts between the U.S. and other jurisdictions—particularly the European Union.

In 2005, Jackson co-sponsored a roundtable conference in England, bringing European and American academics together to explore areas of conflict between U.S. and EU regulators. Partly as a result of the conference, he has co-written an article with two former students analyzing the way the SEC regulates foreign exchanges, particularly those located in the EU. They recommended a change in SEC policy, and two senior SEC officials have recently proposed changes in the SEC’s treatment of foreign exchanges and broker dealers.

Jackson has also been looking at the intensity of financial regulation in different jurisdictions, in a study comparing U.S. and Canadian enforcement activity. He and Professor Mark Roe ’75 have collaborated on what Jackson calls “an empirical extension of this project,” to determine whether higher budgets and staffing in securities market oversight improve capital markets. “They do,” Jackson says. From England, he has also been collecting information on enforcement activities in European and Asian jurisdictions.

Finally, working from interviews with practicing lawyers, Jackson has been studying how international securities transactions are undertaken. This research has demonstrated the extent to which U.S. investors are increasingly going overseas to purchase securities and are making it less necessary for foreign issuers to come to the United States.

Dispelling myths

Roe has been looking at whether the health of a nation’s capital markets depends on the origins of its legal system. In an article published in December in the Harvard Law Review, he examines the widely held assumption that the strength of a country’s financial markets is determined by whether its legal origins are rooted in civil law or instead in common law. Common law institutions have been said to protect outside shareholders, he writes, whereas civil law institutions are said to be less protective and therefore less conducive to healthy capital markets.

Roe finds, however, that the importance of a country’s legal origins has been overstated, and that political factors have been more influential in determining the health of its capital markets. “The stakes aren’t just academic,” he says—there’s a powerful normative reason to get this assessment right. “The developing world and international agencies are told that transplanting the correct legal code (i.e., the common law) will enhance economic development,” he explains. Policy-makers at international development agencies such as the World Bank denigrate civil law-style institution-building, such as regulation, codification and public enforcement, he writes. “Yet, by accepting the academic thinking positing the power of traditional common law tools, they may miss other needed tools not traditionally associated with the common law.”

Roe argues that a country’s legal origins don’t—and shouldn’t—stop it from developing the institutions, legal and otherwise, that capital markets need.

Meanwhile, in his latest book, “The Fable of the Keiretsu: Urban Legends of the Japanese Economy,” published last year by University of Chicago Press, Professor J. Mark Ramseyer ’82 and his co-author, University of Tokyo economist Yoshiro Miwa, set out to disprove some widely held assumptions about the Japanese economy, including the notion that “keiretsu,” or insular business alliances among powerful corporations, like Mitsubishi, dominate the Japanese economy. They also refute the idea that the Japanese government skillfully engineered the postwar economic miracle, and they rebut the popular view that poor corporate governance caused the 1990s recession.

Recently, Ramseyer completed a working paper he co-wrote on the levels of executive compensation in Japanese firms listed on the Tokyo Stock Exchange. He is also at work on an article studying the levels of executive compensation at unlisted Japanese firms.

From corporate responsibility to global antitrust law

Professor Jon Hanson is engaged with the idea of what he calls “progressive corporate law,” and in April he will give a lecture on the topic at an event sponsored by the American Constitution Society. Hanson’s remarks will focus, he says, on “the significant but often overlooked connections between corporate law and many of the concerns occupying progressives, such as racial injustice and economic inequality.”

Hanson comes at the subject of corporate law from a critical legal studies perspective, whereas his colleague Einer Elhauge ’86 takes a law and economics approach. Recently, Elhauge examined what he calls the “canonical view” that corporate managers do and should have a duty to maximize profits and let the legal system redress any harms that their businesses inflict on others. This view is mistaken, he argues in a New York University Law Review article, because the law gives managers considerable discretion to sacrifice profits for the sake of the public interest. Elhauge says that profit-maximization is not a socially efficient goal because even optimal legal sanctions are imperfect and require supplementation by social and moral sanctions. Pure profit-maximization worsens corporate conduct by overriding these social and moral sanctions, he says, and, in addition to being socially inefficient, harms shareholders whenever they value the incremental profits less than they value avoiding those sanctions.

Elhauge has also been studying the increasingly global nature of antitrust law and has just published a casebook, “Global Antitrust Law and Economics” (Foundation Press, 2007), with co-author Damien Geradin. It is, he says, the first law book—not just on antitrust but on any subject—to cover that subject in a global way. “A typical merger between large U.S. corporations must get approval not just in the United States but also by the European Community, for their activities often affect both markets,” Elhauge and Geradin write. And countries are increasingly entering into treaties with each other about the content or enforcement of competition laws, they note. Thus, businesspeople, lawyers and lawmakers can no longer content themselves with understanding the antitrust and competition laws of only their own nations. “This combination of laws from varying nations in actual practice presents a truer picture of the overall regime of competition law that now faces multinational market players,” they write.

Innovation

Finally, the newest member of the corporate law faculty has been delving into the world of innovation—specifically, how parties to contracts can be more creative in designing their deals. Since joining the HLS faculty this academic year from the University of Virginia School of Law, Professor George Triantis, an expert on corporate finance and commercial law, has been focused on the ways that lawyers and clients produce novel and creative contractual terms. In a yearlong seminar, he has been looking at some of the factors that promote or impede innovation, including the impact of judicial, legislative and regulatory action, and in a recent article, he examined ways of anticipating litigation in contract design.