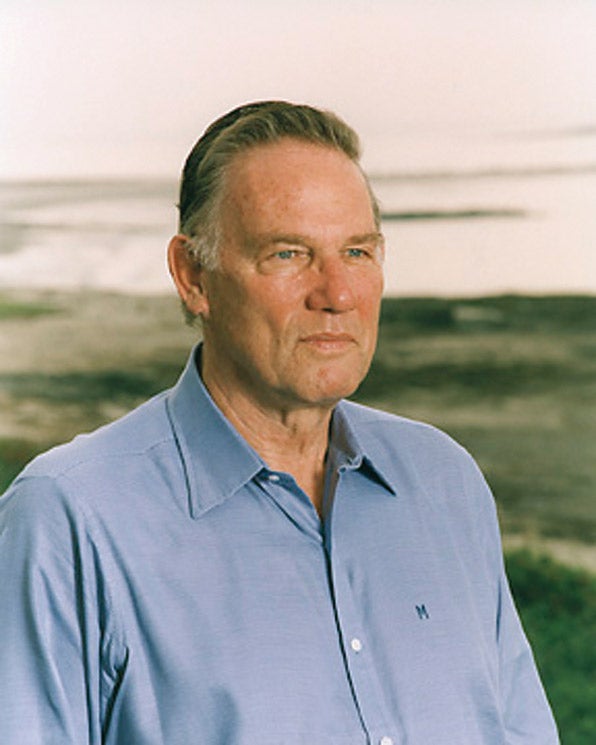

For the past 30 years, Robert A.G. Monks ’58 has worked to change corporate governance and increase management accountability. Now, in the era of Enron, Global Crossing, WorldCom and other wayward companies, more people than ever are paying attention.

His call for increased scrutiny of CEO compensation was a precursor to shareholders’ winning the right to approve “golden parachutes” and other perks at large corporations such as Bank of America. Heading off potential conflict of interest through more objective governance has become a growing priority as well. And companies have followed, such as data-storage firm EMC, where shareholders recently resolved that a majority of its board members must be independent of the company and its financial concerns.

In 1985, the Boston native founded Institutional Shareholder Services Inc., a corporate governance consulting firm that advises major institutional investors with assets in excess of $1 trillion on how to vote their proxies. Lens, an investment management fund that uses shareholder activist tactics (such as agitating for management changes or board seats), has outperformed the S&P 500 every year since Monks established it in 1992.

His goal, he said, is to create “a culture of ownership responsibility” that will ensure that pension fund trustees, mutual fund managers and boards of directors will represent the interests of shareholders instead of making decisions based on personal gain.

“Our government was founded on the idea that we have to elect and legitimize the people who have power over us,” said Monks. “But there weren’t any corporations in 1789, so this question has always intrigued me: Now that corporations have an inordinate amount of influence, how do we get the equivalent of a constitutional settlement?”

Shareholders, Monks explains, are the best correction for corporate power; “cheat-proofing” the system through external controls won’t work because corporations will outmaneuver new policies through lawyers and lobbyists.

The author of five books and hundreds of articles and speeches, Monks recently wrote “Capitalism Without Owners Will Fail,” a 20,000-word pamphlet; “To Harvard with Love,” a book that urges the university “to re-examine its position as an owner of major corporate ventures”; and a novel about “a hypothetical takeover of Reader’s Digest by a Rupert Murdoch-type guy.” Fiction, he says, has provided a welcome respite from the demands of advocate work. “If you’re used to promulgating ideas for which there isn’t much acceptance,” he said, “writing a novel is pure heaven.”

Monks has more influence than he lets on. His work with trustees of California’s public employees pension fund–one of the country’s most influential institutional investors–led to the replacement of CEOs at Eastman Kodak, Borden and Scott Paper, among other corporations. He also lectures regularly at the University of Cambridge, where his fund-raising efforts established a program in corporate governance.

For Monks, fighting the good fight for shareholders requires a broad-based approach. His most recent tactic: working as a consultant with Milberg Weiss, a firm that specializes in securities class-action lawsuits. In the settlement phase, he explains, shareholders usually get stuck paying for malfeasance committed by a company’s directors. Through further litigation, Monks hopes to win damages for shareholders–and create another point of leverage to persuade management that a change in governance is needed. It’s an uncertain strategy, he says, since winning the case doesn’t ensure that those changes will be made. “But that’s one of the virtues of entering your 70th year,” he said. “It’s a time to try new things. If you don’t, who will?”

–Julia Hanna