Areas of Interest

Financial and Monetary Institutions

-

In "The Problem of Twelve," John Coates argues that a small number of large financial institutions increasingly pose a threat to American democracy and to themselves.

-

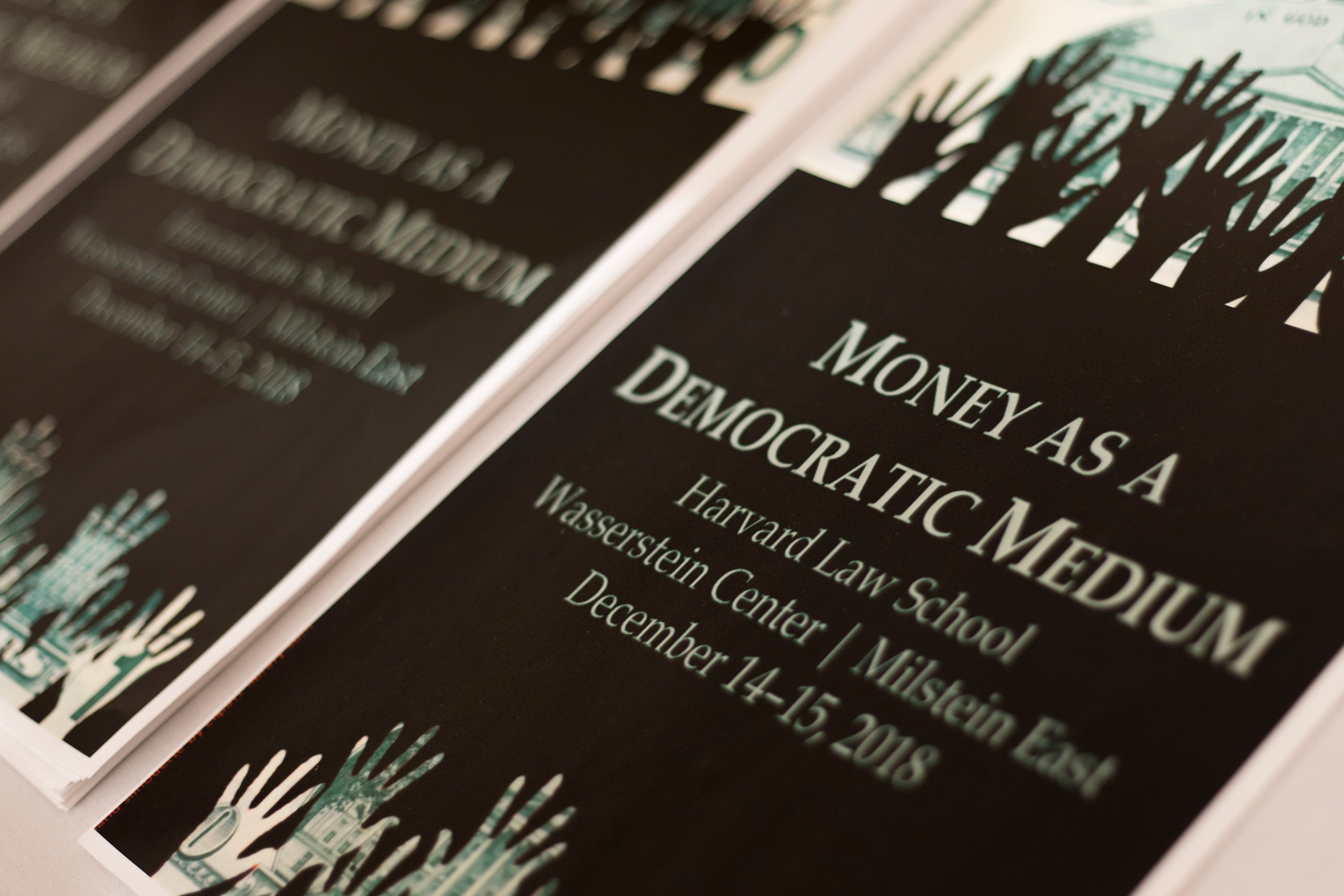

Experts discuss “Money as a Democratic Medium” at a conference organized by Harvard Law School Professor Christine Desan.

-

Bailouts for everyone?

March 16, 2023

Daniel Tarullo, who served as a Fed regulator, discusses the moral hazard and the implications for inflation after the SVB collapse rocks Washington and Wall Street.

-

‘A genuine debt ceiling crisis’?

January 23, 2023

Howell Jackson discusses what could happen if the United States defaults on its debts for the first time in history.

-

On the bookshelf

December 13, 2022

This fall, Harvard Law School showcased the works of faculty, alums, and students at book events throughout the semester.

-

Former Deputy Treasury Secretary Daleep Singh and Federal Reserve Board Member Chistopher Waller debate whether to create a U.S. central bank digital currency.

-

‘The path of rate increases may indeed lead to a recession’

September 23, 2022

Harvard Law Professor Daniel Tarullo says the Fed hopes to convince markets — and the public — that it will fight inflation, even if there are costs.

-

Take the money and run

September 12, 2022

Six months after cryptocurrency won the Super Bowl ad game, Harvard Law Professor Howell Jackson proposes a way to stabilize the now swooning industry.

-

In recent paper, Howell Jackson and Timothy Massad propose that the U.S. Treasury Department implement a new mechanism to improve financial services for financially vulnerable households and expedite delivery of government benefits.

-

The Crypto of the Realm

January 31, 2022

A Harvard Law class explores possibilities for a U.S. central bank digital currency, which would be sheltered from the wild fluctuations in value for which crypto is known.

-

Fed up with inflation

January 24, 2022

Former Federal Reserve Bank member Daniel Tarullo says the Fed has “fallen behind the curve” in raising interest rates to help tame rising inflation and “needs to play some catch-up.”

-

Harvard Law Professor Christine Desan says the Biden administration is harnessing fiscal and monetary policy to bolster the economy, but should move faster to address climate change, crypto markets, public banking.

-

Going public

July 7, 2021

Harvard Law School students are working to create a Massachusetts public bank to help minority-owned businesses, small farms, and gateway cities.

-

Money as a Democratic Medium

January 11, 2019

Harvard’s recent two-day conference, “Money as a Democratic Medium,” challenged its participants to re-examine the history of money in America, and to redefine its future.

-

Money as a Democratic Medium: A Q&A with Christine Desan

January 11, 2019

Christine Desan, the Leo Gottlieb Professor of Law at Harvard Law School, organized the conference, “Money as a Democratic Medium,” a two-day event that challenged its participants to re-examine the history of money in America, and to redefine its future.