People

Mark Roe

-

Harvard Law School faculty members are currently featured prominently on SSRN’s list of the 100 most-cited law school faculty in all fields.

-

On the bookshelf

December 13, 2022

This fall, Harvard Law School showcased the works of faculty, alums, and students at book events throughout the semester.

-

‘Misunderstanding how the world works’

November 9, 2022

Harvard Law Professor Mark Roe says that Wall Street short-termism has gotten a bad rap.

-

Mark J. Roe Says More…

August 30, 2022

Project Syndicate: In your new book, Missing the Target: Why Stock-Market Short-Termism Is Not the Problem – and in a number of PS commentaries –…

-

Faculty Books in Brief: Summer 2022

July 2, 2022

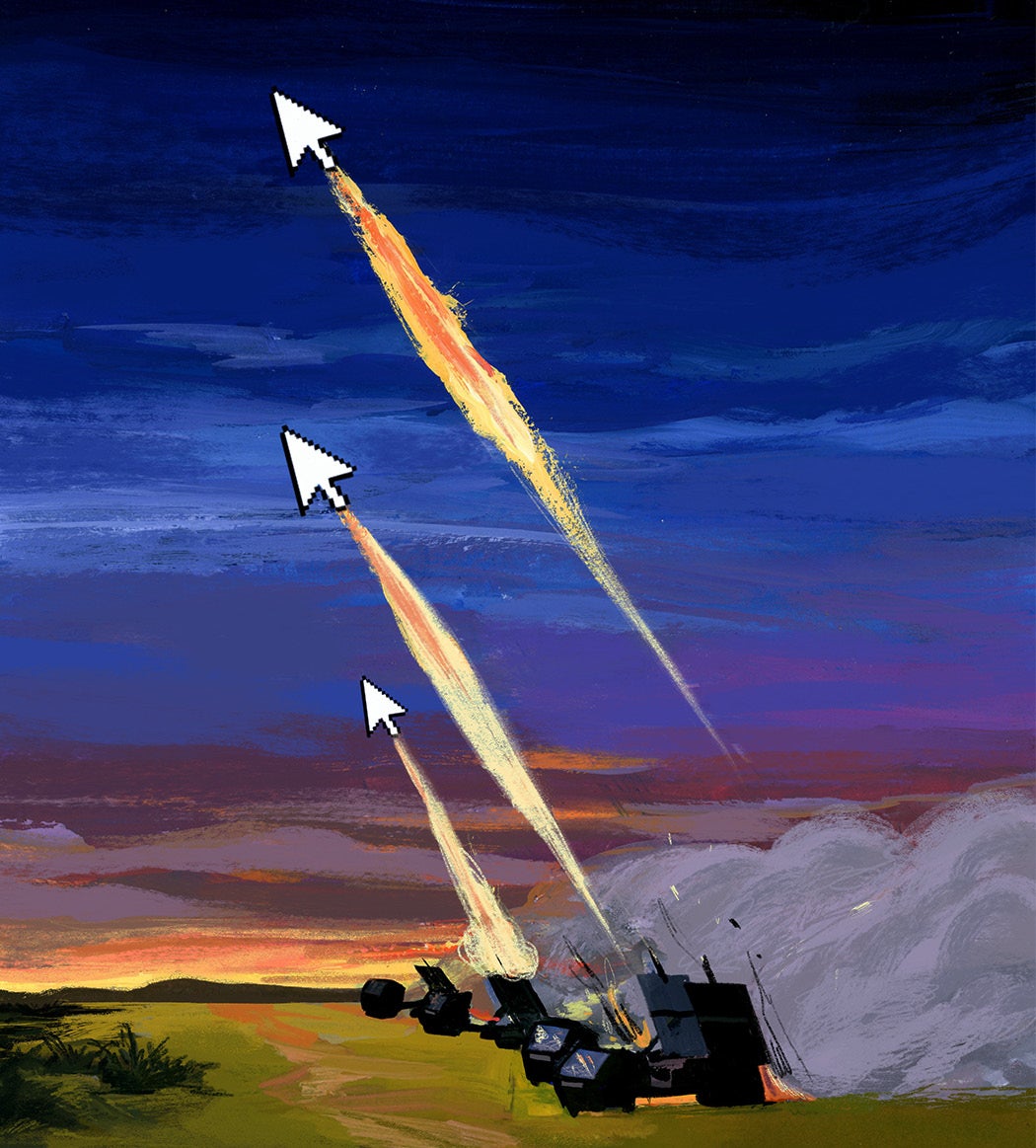

From the Hughes Court to stock market short-termism to the U.S.'s "defend forward" cyber strategy

-

Articles by Harvard Law faculty and alumni among top ten corporate and securities articles of 2021

June 22, 2022

Articles by four Harvard Law faculty were selected in an annual poll of corporate and securities law professors as three of the ten best corporate and securities articles of 2021.

-

Quarterly Capitalism Isn’t Ruining the World

April 6, 2022

Stock-market short-termism is that rare enemy that unites left and right, management and employees, and some of the world’s biggest fund managers and consultants. On the left, “quarterly capitalism” is shorthand for venal executives and greedy shareholders abusing workers and the environment in pursuit of unsustainable profits. On the right, critics fear short-term-oriented stockholders pressure management to make dumb decisions, depressing investment and the economy. Neither is correct, as a compelling short book from Harvard Law School Professor Mark Roe shows. And that matters for public policy, lawmakers and the dominant narrative in how America’s corporations are run. There are plenty of problems, but they need different fixes.

-

Does stock market short-termism make capitalism irresponsible?

February 23, 2022

An article by Mark Roe: Stock market short-termism is said to drive ESG and CSR shortfalls, worsening environmental quality and global warming in particular, making the corporation less responsible. A stock market of rapid traders is not a stock market, in the conventional view, that can think about sustainability and climate catastrophe. The recent EU initiative on sustainable capitalism (such as via this study) strongly asserts this proposition, and it is one that is widely believed on both sides of the Atlantic. “The short-term payback periods of financial markets take precedent over the long-term time horizons of ecological and social systems,” says one analysis. “The finance world’s short-termism will destroy our communities, economies and the planet,” the World Economic Forum was told in Davos.

-

Why the bias for debt over equity is hard to dislodge

January 24, 2022

The niceties of corporate finance rarely attract the attention of activists. It is rarer still that those at either end of the political spectrum agree on the need for change. When it comes to the tax system’s preferential treatment for debt over equity, however, both the left-wing Tax Justice Network and the fiscally conservative Tax Foundation agree that the “debt bias” needs correcting. But the degree of consensus belies the difficulty of getting it done. ... What would wholesale reform look like? In a paper published in 2017, Mark Roe of Harvard Law School and Michael Tröge of ESCP Business School put forward some ideas. One is to treat debt less preferentially. They imagine a bank with $50bn in gross profits and $40bn in interest payments. With full deduction for interest and a corporate-tax rate of 20%, the bank would pay tax of $2bn, and have an incentive to rack up debt. But if the interest deduction were removed altogether, a tax rate of 20% would wipe out the bank’s entire net profit. One solution would be to withdraw deductibility, but to lower the tax on gross profits. A rate of 7% in that scenario would yield as much to the taxman, and pose the same burden to the bank, as a 35% tax on net profits.

-

Ending Tax Law’s Subsidy for Corporate Debt

January 5, 2022

An article by Mark Roe and Michael Troege: Debates on the corporate tax are mostly about “how much"—not about “how.” The debate over recent corporate tax plans is no exception. Congress moves tax rates up or down, but the structural imbalances that have built up in the U.S. tax code because of the “how” are ignored. When Sen. Kyrsten Sinema (D-Ariz.) opposed any rise in the corporate tax rate, talk turned to other tax possibilities. With the budget scoring indicating that better enforcement and auditing will not produce the predicted bonanza, corporate tax reform may well come back into focus.

-

Canada should tax bank debt, instead of bank equity

September 14, 2021

An op-ed by Mark Roe and Michael Troege: The Liberal party announced its plan to raise the corporate tax rate on large banks and insurance companies from 15 per cent to 18 per cent. Maybe the banks should pay more taxes; maybe not. But if banks need to be taxed more, this is not the right way to do it. It will incentivize them to take on more debt, creating unnecessary dangers if an economic crisis hits the Canadian banking system.

-

Hiking bank taxes can be done more safely than what’s proposed: Harvard Law professor

September 1, 2021

Mark Roe, corporate law professor at Harvard University, joins BNN Bloomberg to discuss the Liberal party’s plans to hike corporate taxes for banks and insurers. He notes that taxing bottom line profits (instead of gross profit before deducting interest on debt) would result in less equity for the Banks should a downturn arise, because debt is tax-favoured. But he notes it’s likely not enough a tax increase for institutions to move money into other parts of the business.

-

Policies to hike bank taxes are pushing in the wrong direction: Harvard Law professor

August 30, 2021

Mark Roe, corporate law professor at Harvard University, joins BNN Bloomberg to discuss the Liberal party’s plans to hike corporate taxes for banks and insurers. He notes the move might result in less equity for the Banks should a downturn arise, but notes it’s likely not enough a tax increase for institutions to move money into other parts of the business.

-

Clearinghouses Are Intended to Reduce Risk. They Can Amplify It.

February 3, 2021

The Depository Trust + Clearing Corp. is unpopular with the trading bros on r/WallStreetBets for its role in short-circuiting the short squeeze in GameStop Corp. shares. But you don’t have to care about the raucous GameStop gamers and their “diamond hands” to be concerned about the DTCC’s intervention in the episode. Clearinghouses are intermediaries that make sure sellers of securities get paid, and buyers of securities get what they paid for. Here’s the problem in a nutshell, according to several market experts: The DTCC and its three clearing subsidiaries are focused exclusively—and understandably—on protecting the markets they serve. When risk increases, the clearinghouses demand more collateral from their customers as a safety buffer. But that collateral has to come from somewhere. So making the DTCC clearinghouse safer could leave other parts of the financial system with thinner safety buffers...This is not a new concern. In a 2013 article for the California Law Review, Harvard Law School professor Mark Roe wrote that clearinghouses “are efficient financial platforms in ordinary times” but “do little to reduce systemic risk in crisis times.” That’s because, he wrote, “The major reduction in risk among the inside-the-clearinghouse traders is largely achieved by pushing that risk elsewhere, often to a systemically dangerous spot.” The risk, in other words, is like a balloon that expands in one place when squeezed in another.

-

Harvard experts slam EU report on long-term strategic thinking

October 28, 2020

Four Harvard professors have criticised a recent European Commission report that proposes reforms to encourage long-term strategic thinking. The commission’s report aims to tackle short-term management of companies and make them more sustainable. The wince-inducing conclusion of four Harvard academics is that the commission report contains “deep flaws”, “mistakenly conflates” key factors, fails to engage with alternative sources of evidence and “touts cures” backed by “little evidentiary support”. Some of the cures proposed by the report, the four argue, could be “counterproductive and costly”. Amounting to a brutal comment on the complexity of sustainability, The European Commission’s Sustainable Corporate Governance Report: A Critique, illustrates the difficulty governments may encounter when attempting to legislate for long-term strategic thinking in large listed companies. The European Commission’s report, written by the business advisory firm EY, concludes that far too many company directors across the EU continue to think short term instead of acting in the long-term interests of their stakeholders. It presents evidence and then sets about detailing the remedies. The Harvard professors—Mark Roe, Holger Spamann and Jesse Fried of Harvard Law School, and Charles Wang of the university’s business school—say it’s mostly wrong. First, the academics argue, the report confuses the definition of the problem. In focusing on the issue of “short-term” business thinking, they say the report “conflates” timeframes with problems stemming from “externalities” and the “distribution” of benefits. That’s three topics probably needing different cures, they say. “For policy analysis, however, the conflation is seriously debilitating. Real world companies will often fall short on all three dimensions, but cures for one may exacerbate another,” they write. Then there is the issue of flawed evidence of short-termism.

-

In the wake of Vince McMahon’s Alpha Entertainment reaching an agreement to sell the XFL for $15 million, creditors are left wondering if they’ll see any of the money. As first reported by Sportico’s Scott Soshnick, a group that includes former WWE star Dwayne “The Rock’’ Johnson and RedBird Capital CEO Gerry Cardinale will buy the team, pending approval by U.S. Bankruptcy Judge Laurie Selber Silverstein. “I’ll be lucky to get pennies on the dollar,” a sports business professional who operates a small company tells Sportico...As an unsecured creditor in Alpha’s chapter 11 bankruptcy, the source lacks any collateral in Alpha’s properties or assets. It also means they’ll be among the last in line to collect any proceeds from the sale. The XFL, the professional maintains, owes them tens of thousands of dollars for services already rendered...One factor advantaging Alpha—and as acknowledged by creditors in their objection—is that, as the debtor, Alpha is entitled to deference in seeking approval of the proposed sale. A related factor is that the relevant legal standard for review is not especially difficult to meet. That standard is the business purpose test, which requires there be a sensible reason for the sale and a fair price for it. Harvard Law School Professor Mark Roe, an expert in bankruptcy law, highlighted these factors in an interview. The business purpose test, Roe said, is “usually an easy standard to satisfy as the sales’ proponents just have to give a plausible justification.” He surmises that for this sale, “it could have been XFL has been languishing and a new owner like Dwayne Johnson can give it a boost of publicity.” Where Roe sees Alpha potentially running into more trouble is “the structure of the auction and the relationships.” “Even if there’s a business purpose,” Roe notes, “the court should be structuring an auction that’s fair and likely to bring forward the best price.” Roe believes the court will attempt to determine if insiders downplayed asset value. In that instance, “the bidding documents would be defective.” Roe also draws attention to the creditors’ concern about the sale potentially releasing the insiders of causes of action—“that,” Roe said, “would be another issue separate from whether there was a sound business purpose.”

-

J. Crew and Neiman Marcus are among the first major retailers to file for bankruptcy as the coronavirus pandemic further disrupts an industry that was already having its fair share of struggles. Others are expected to follow suit, with JCPenney seeming a likely candidate as it reportedly postpones a major debt payment. Filing for Chapter 11 bankruptcy protection gives distressed companies a chance to reorganize and get a fresh start. But retail companies going through bankruptcy proceedings right now are facing a set of difficulties that wouldn’t be happening if not for the pandemic. Being unable to predict stores’ future sales is a major challenge, as is not having a way to hold going-out-of-business sales while locations remain closed in certain states. Some experts are also starting to worry about what could happen if too many companies end up filing for bankruptcy protection at once...Ben Iverson, a professor at Brigham Young University, and Mark Roe, a professor at Harvard Law School, argued in an op-ed on Project Syndicate that the bankruptcy court system should immediately work to expand its capacity to hear cases in order to avoid these issues. “For starters, special procedures are needed for bankrupts to pay critical suppliers and sometimes employees. If courts are backed up, these payments will be delayed, causing disruptions to ripple throughout supply chains,” they wrote. They continued: “Furthermore, some bankruptcy decisions must be made almost immediately so that businesses can get and keep enough cash to stay alive through their next payroll.” The authors pointed out that bankruptcy filings typically surge several months after unemployment filings start to grow at an exponential rate.

-

Swamped bankruptcy courts threaten US recovery

May 15, 2020

In early March, just as Covid-19 was spreading alarm in the west, the US sporting goods retailer Modell’s filed for bankruptcy. The company has long been blighted with excess debt and poor sales, and was overdue for a shakeout. What happened next was odd — and symbolic. In the last two months, courts have repeatedly frozen Modell’s bankruptcy process, citing the pandemic. The company is now a zombie, neither dead nor alive. Its status could soon proliferate across corporate America, further confusing the economic outlook...Rating agencies project that default rates among companies whose debt they consider risky will hit or exceed the 15 per cent level seen after the 2008 crisis. Law professors Benjamin Iverson and Mark Roe predict “the biggest surge in bankruptcies” that the US court system has ever seen...The fifth — and biggest — problem is a shortage of judges. Profs Iverson and Roe calculate that if bankruptcies surge to 2008 levels, “a US bankruptcy judge would have to work close to 50 hours per week to keep up with the increased caseload”. However they fear that bankruptcy rates could actually be double the 2008 level. “No one can expect bankruptcy judges to work 100 hours per week,” they lament. Not even, presumably, with Zoom.