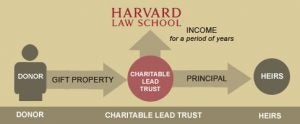

What is a Charitable Lead Trust?

Charitable lead trusts distribute an annual percentage amount to HLS for a term of years, typically 10 to 20 years, and then either distribute the remaining trust principal to heirs at a reduced gift and estate tax cost or return the trust assets to you.

The annual distribution from a charitable lead trust is typically a fixed amount, an annuity, established when the trust is created and expressed as a percentage of the value of the trust’s funding assets.

How Do Charitable Lead Trusts Work?

The payout percentage of most Harvard-managed trusts ranges from 5% to 7%. The minimum amount necessary to set up a lead trust at Harvard is $1 million. Donors may also establish a lead trust with their preferred trust company.

Cash and securities with a high-cost basis are the best funding assets, as lead trusts are taxable trusts, and appreciated assets are subject to capital gains tax when sold by the trust.

Harvard-managed lead trusts are invested in a diversified portfolio designed to provide exposure to a wide variety of domestic, foreign, and emerging markets.

If you choose Harvard as the trustee of your trust, Harvard will provide the trust document and numerical illustrations for you to review with your advisors.

Gift Calculator

The gift calculator below will allow you to test out different charitable lead trust scenarios. Click on “Personalize This Diagram” to fill in your gift hypotheticals, including property type, beneficiaries, and gift term, then click “Submit” to see the results.

Questions?

For any questions about charitable gift annuities, making a planned gift to Harvard Law School, or about any of the related tax benefits, please contact:

Charlize Suzanne Gordy

Director, Planned Giving

(617) 496-9265

cgordy@law.harvard.edu