As of May 2015, more than 300 research studies have applied the Entrenchment Index put forward in the study What Matters in Corporate Governance?, published by Harvard Law faculty members Lucian Bebchuk, Alma Cohen and Allen Ferrell. The papers using the Entrenchment Index, including many papers in leading journals in law, economics and finance, are listed here.

The paper, first circulated in 2004 and published in 2009 in the Review of Financial Studies, identified six corporate governance provisions—four constitutional provisions that prevent a majority of shareholders from having their way (staggered boards, limits to shareholder bylaw amendments, supermajority requirements for mergers, and supermajority requirements for charter amendments), and two takeover readiness provisions that boards put in place to be ready for a hostile takeover (poison pills and golden parachutes)—that are associated with economically significant reductions in firm valuation. The paper put forward a governance index, commonly referred to as the “Entrenchment Index,” based on these six provisions. It has been cited by more than 650 research studies, and more than 300 of these studies made use of the index in their own empirical analysis.

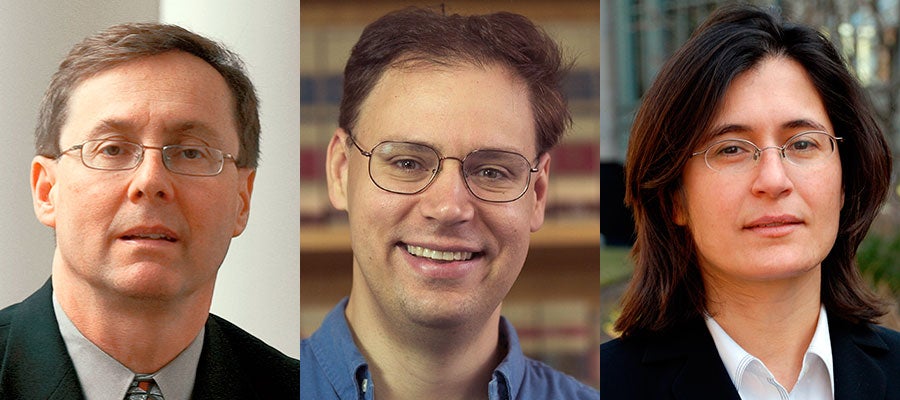

Bebchuk is William J. Friedman and Alicia Townsend Friedman Professor of Law, Economics, and Finance and Director of the Program on Corporate Governance at HLS, Cohen is Professor of Empirical Practice at HLS, and Ferrell is Greenfield Professor of Securities Law, Harvard Law School. Their paper putting forward the Entrenchment Index is available for download on the Social Science Research Network (SSRN).