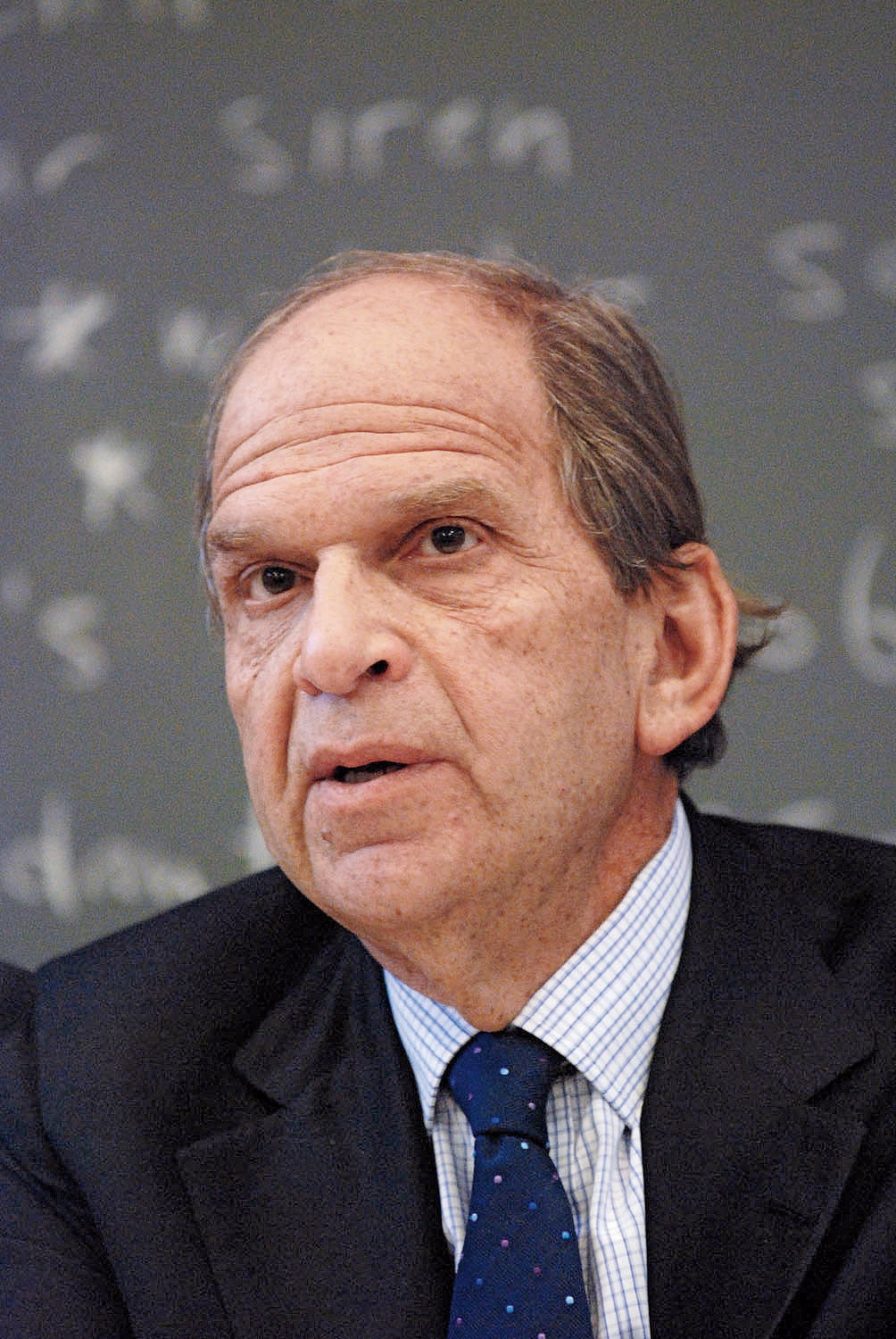

On October 23, 2008 HLS hosted a panel discussion titled Corporate Leadership in a Time of Turmoil. Moderated by Professor Bob Clark ’72, the discussion featured panelists Domenico De Sole LL.M. ’72, chairman of the Tom Ford fashion label and former chairman and CEO of the Gucci Group; Frank Dengeard LL.M. ’85, former chairman and CEO of Thomson SA; and Bruce Wasserstein JD/MBA ’71, chief executive of Lazard LLC.

De Sole described how he turned around the Gucci Group from its lowest point in 1994 (when the company found itself unable to make payroll) to a $10 billion leader in the luxury goods industry. “We turned the company around very, very quickly,” said De Sole. He attributed his success as a CEO to three main attributes—the ability to share credit with others in the company, the ability to recognize talent within the company, and a sense of who the internal leaders are and what the company’s priorities are. He also described how Gucci anticipated and responded to various changes in international markets, including the Asian financial crisis of the late 1990s, and also talked about how Gucci expanded during times of economic difficulty, focusing on Gucci’s acquisition of high-fashion brand Bottega Veneta.

Dengeard described his career working with government-owned, bankrupt companies, which included Thomson, France Telecom, and another division of Thomson over the course of 10 years. In 2004, he worked with Thomson when it was on the verge of bankruptcy. At the time, the company produced consumer electronics, including RCA brand electronics. Dengeard described how he essentially saved the company by focusing on re-building what the company did best —namely, video solutions for broadband technologies—and selling off all of the divisions that didn’t do as well as other companies. Dengeard identified four things that were key to his success: the ability to define the project; the ability to prioritize and execute plans; encouraging “buy-in” from customers and employees; and focusing on “people issues,” building strong teams to support the company. He also discussed his decision to leave Thomson as a result of fundamental disagreements with the company’s board regarding its future.

“It’s, of course, about ruling with a big ‘R,'” said Dengeard, “but the most important to me has always been the soft side of leadership, which has to do with being accountable, which has to do with integrity… and has a lot to do with empathy.” Transitioning to the current economic crisis, he said that “in times of turmoil, decisiveness is absolutely key.”

Wasserstein focused a great deal on leadership, and how crucial it will be in facing the current economic crisis. When describing ideal leadership, Wasserstein talked about how important it is for leaders to be aware of, and prepare to compensate for, their own weaknesses, and to surround themselves with people who can fill in the gaps in their own expertise—for example, visionaries must be sure to surround themselves with planners who are strong at execution. He also offered a view of how the current economic crisis came about, and how various investment banks created portfolios that were disproportionately risky. “What happened was the firms had financial risk. They were leveraged 30 to one—interesting idea—plus, they were using the money not to buy government securities, but to buy risky securities,” he said. “If you think of the margin for error there, and it’s not a very complicated idea, that had a real good chance of blowing up.”

In closing, Wasserstein said that “in the crisis, leadership is about looking to the future, but being very concerned about the present and just using a little bit of common sense.”

To view the entire panel discussion, click here. Harvard Magazine also included coverage of the panel on their website on Oct. 24.