The legal journal Corporate Practice Commentator recently announced the 10 Best Corporate and Securities Articles of 2014. Half of the top ten articles selected this year were written by Harvard Law School faculty members.

Based on a poll of academics in the corporate and securities field, papers by Harvard Law School Professors Jesse Fried, Mark Roe, Guhan Subramanian and Leo Strine were selected as among the very best of the more than 525 articles on this year’s list. This was the Corporate Practice Commentator’s 21st annual poll to select the ten best corporate and securities articles.

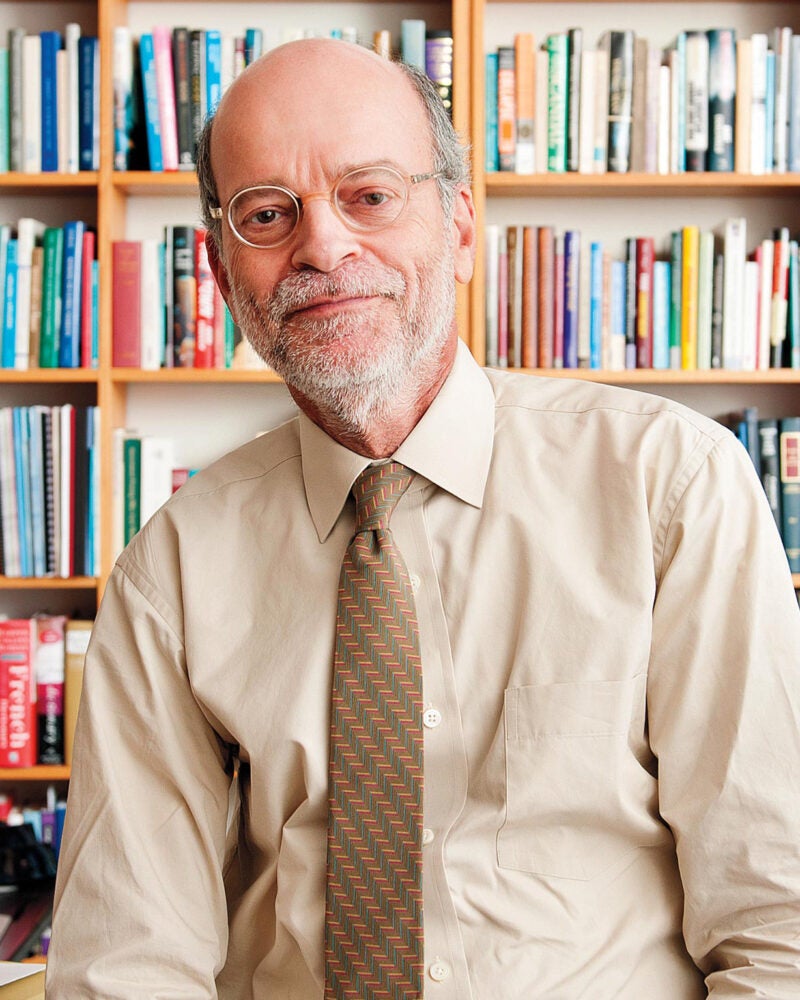

The paper by Professor Jesse Fried ’92, “Insider Trading via the Corporation,” was published in the University of Pennsylvania Law Review. It explains how corporate insiders with substantial equity stakes in a firm can use share repurchases and equity issuances to systematically transfer value from public investors. To reduce the costs of such indirect insider trading to public investors, Fried offers a simple proposal: require a firm to disclose trades in the firm’s shares within two business days.

Two papers from Professor Mark Roe ’75 made the list. Structural Corporate Degradation Due to Too-Big-To-Fail Finance, published in the University of Pennsylvania Law Review, examines how and why financial conglomerates that have grown too large to be efficient find themselves free from the standard and internal and external corporate structural pressures push to resize the firm. Roe also received the European Corporate Governance Institute (EGCI) 2015 Allen & Overy Working Paper Prize for this article.

Roe’s article, Breaking Bankruptcy Priority: How Rent-Seeking Upends the Creditors’ Bargain, written with Professor Frederick Tung from Boston University and published in the Virginia Law Review, explains how priority jumping interacts with finance theory and how it should lead to reconceptualizing bankruptcy not as a simple creditors’ bargain, but as a dynamic process with priority contests fought in a three-ring arena of transactional innovation, doctrinal change and legislative trumps.

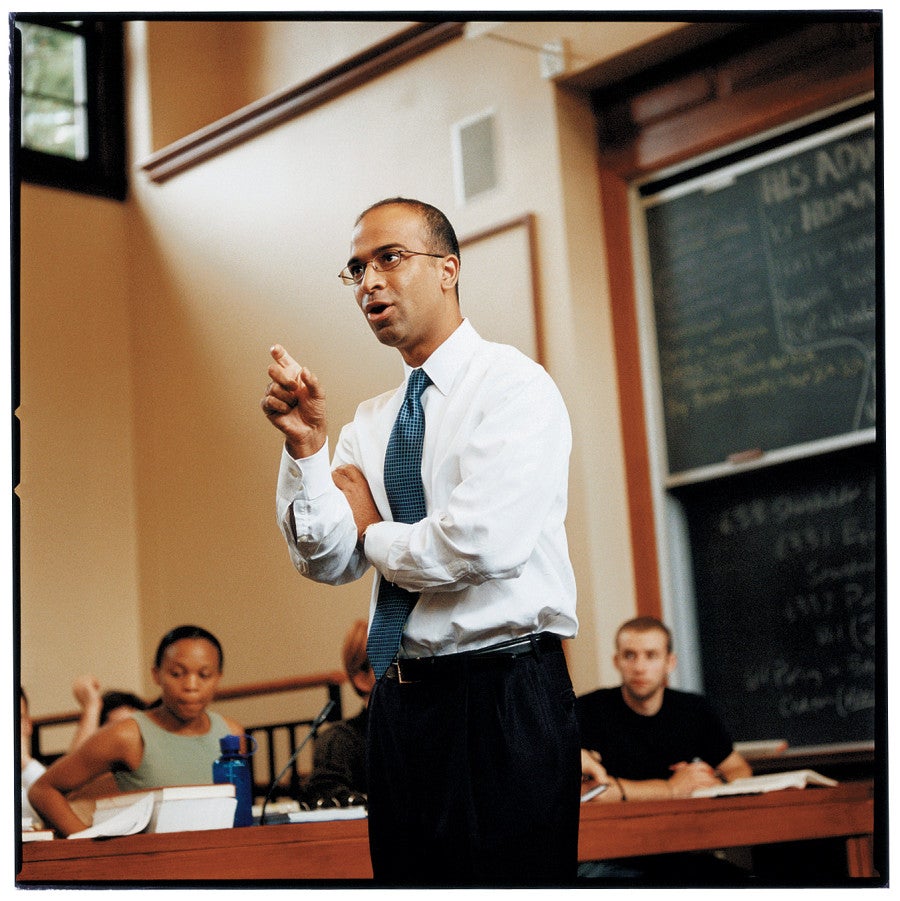

Professor Guhan Subramanian J.D./M.B.A ’98, who holds tenured appointments at both HLS and Harvard Business School, was recognized for his article, Delaware’s Choice, which was given as the Pileggi Lecture at Widener Law School in Wilmington, Delaware and published in the Delaware Journal of Corporate Law. The article describes and assesses the evolution of staggered boards and antitakeover statutes under Delaware corporate law.

Leo E. Strine, Jr., chief justice of the Delaware Supreme Court, HLS Program on Corporate Governance senior fellow and lecturer on law, was recognized for his essay, Can We Do Better by Ordinary Investors? A Pragmatic Reaction to the Dueling Ideological Mythologists of Corporate Law, published in the Columbia Law Review. The essay focuses on the practical realities surrounding increases in stockholder power in an era where there is a “separation of ownership from ownership.”

Also in the top ten was an article by Tess Wilkinson-Ryan, a visiting assistant professor of law at HLS in the winter of 2015. Her article, co-written with Jill E. Fisch, was titled, Why Do Retail Investors Make Costly Mistakes? An Experiment on Mutual Fund Choice.