For the last several years, former HLS Dean Robert C. Clark ’72 has broken with tradition in teaching his mergers and acquisitions course. It isn’t enough to read leading cases, he realized; students still may leave the classroom without any real understanding of how to structure a deal, identify and avoid pitfalls, and recognize why personalities matter—in short, how M&As work in the real world.

So Clark decided to bridge the storied gap between the academy and the world of practice, an approach unheard of in corporate law classes 10 years ago. He co-teaches the course Mergers, Acquisitions, and Split-Ups, with Leo E. Strine Jr., chancellor of the Delaware Court of Chancery, who offers a behind-the-scenes view of boardroom negotiations and the personalities involved, a perspective very popular with students. “Learning the cases in this context made the material readily digestible,” recalls Oscar Hackett ’09, CFO and general counsel of BrightScope Inc.

Moreover, at least a quarter of the classes over the semester include guest speakers who offer an invaluable real-world point of view: CEOs, M&A experts from major law firms, and lawyers from private-equity and public companies, who discuss deals in which they’ve been involved.

The alliance between the academy and the world of practice yields benefits for both. Theodore Mirvis ’76, a partner at Wachtell, Lipton, Rosen & Katz and a top M&A lawyer, has been a guest in Clark’s class several times. “I’ve had questions asked of me by students that were far more difficult and perceptive than any I’ve had in a courtroom,” Mirvis says. “It forces you to have a new perspective.”

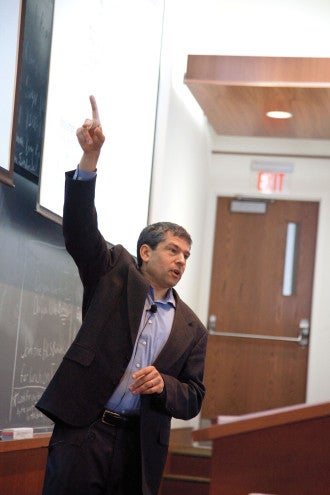

The benefits of this teaching model may seem obvious. Yet it’s radically different from what Clark himself experienced as a student at HLS. “There wasn’t much connection with law practice at all,” Clark recalls. Many professors had never stepped outside the academy, and even those with experience as practicing attorneys adopted the traditional pedagogy once they joined the faculty, perhaps sprinkling in a few of their own war stories during doctrinal lectures.

But today that is changing rapidly, not only in Clark’s classes but in others taught by his corporate law colleagues at HLS, who have found many ways to bring the world of practice into the classroom to give students insights on deal-making, contract negotiations, hostile takeovers, leveraged buyouts and more. We highlight a few of those efforts.

Looking Beyond the Cases to the Client

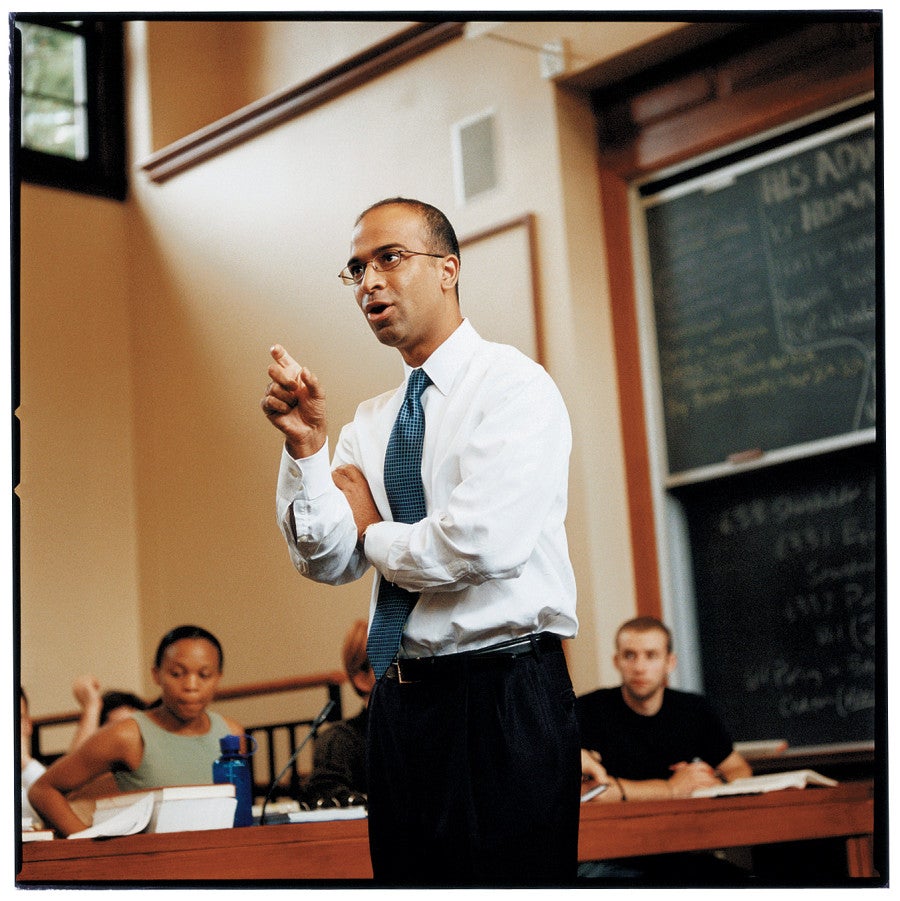

Professor John Coates

Corporations: Board of Directors and Corporate Governance

For a student like Neil Rao ’13, who sits on the board of a nonprofit corporation and spent two years at McKinsey & Co. advising hospitals and other corporations, the traditional law school course on corporations would have limited value. “To me, the distinction between an S corporation versus a C corporation—I can read that,” he says.

Rao enrolled in a new kind of course with a practical approach, taught jointly by Professor John Coates—who also teaches M&A and came to HLS after nine years at Wachtell—and Harvard Business School Professor Jay Lorsch. The students simulate the roles they will play as corporate lawyers and executives after they graduate. Rather than focusing solely on appellate cases, Coates and Lorsch focus on the daily decisions by and interactions between corporate lawyers and their clients, including addressing the personalities involved in corporate governance and the complex dynamics among shareholders, executives, boards of directors and lawyers.

The 100 students in the class—half from HLS, the other half from HBS— team up in exercises that mimic the kinds of interactions corporate lawyers have in advising their clients. Students are encouraged to participate in solving problems a real client is likely to run into.

“One of the law students will say, ‘You should have done this,’ but the business student will say, ‘That would be bad for the following reasons,’” says Natasa Kovacevic ’13, who plans to do M&A work after graduation. This kind of practical application of legal theory is essential, she says. For the many HLS students planning to go into corporate transactional work, she adds, “it’s a great way to run a class.”

How Corporate Lawyers and Venture Capitalists Operate

Professor Jesse M. Fried ’92

Corporations; Venture Law and Finance

In his Corporations course, HLS Professor Jesse M. Fried ’92 typically invites several prominent corporate lawyers to talk to students about their careers as well as recent deals and cases they have worked on. For his course on venture capital, he brings in not only attorneys, but also venture capitalists and entrepreneurs.

“Students love it,” Fried says. “They want to hear about the world they’ll be entering from the people they’ll be working with. Plus they enjoy seeing that what they learn in class is actually used in practice.” Fried notes that law faculty are much more connected to the world of practice today than they were 30 years ago and recognize the value of bringing that perspective to the classroom.

A practitioner perspective is particularly useful in the venture capital course because case law and financing documents cannot capture much of what goes on in entrepreneurial startups. There’s another benefit to inviting outside speakers: Students make contact with people who may mentor them or even offer them jobs, he says. During the past two years, Sarah Reed ’91, general counsel of venture capital firm Charles River Ventures, has not only spoken to students, but also hired several to work as interns. “The more interactions students have with practitioners like Sarah, the better,” Fried says.

Real Deals

Professor Guhan Subramanian J.D./M.B.A. ’98

Dealmaking

As the first person in the history of Harvard University to hold tenured appointments at both HLS and HBS, it may seem only natural that Guhan Subramanian J.D./M.B.A. ’98 includes students from both schools in his course on deal-making, and splits the class between both locations. After a few introductory sessions, the course leaps into examining real deals taking place at that time, chosen not for their dollar value (although there are some high-profile deals in the mix) but for the interesting issues of structuring and dynamics that they raise. Bankers, lawyers and CEOs at the center of those deals come to the class to provide their perspectives, says Subramanian, who has written an accompanying text, “Dealmaking: The New Strategy of Negotiauctions.”

Subramanian adopted this approach based on his experience on the faculty at HBS in the late 1990s, where case studies and guest speakers were a common pedagogical tool. “If every single course at HLS was focused on the practitioner’s perspective, I think we’d be missing something.” But offering a spectrum of choice, from pure theory to practical courses, gives students the benefit of both, he says.

A Fuller Picture of the Business Landscape

Professor Kathryn Spier

Business Strategy for Lawyers

Professor Kathryn Spier’s course, which she began offering at HLS four years ago, presents the fundamentals of business strategy and includes business school case discussions in addition to traditional lectures. The class presents economic and game-theory approaches to business strategy and explores topics such as strategic positioning, product differentiation, performance evaluation, battles for corporate control, franchising, joint ventures, network externalities and innovation. Case studies include the cola wars between Coke and Pepsi and issues touching on Microsoft and on Wachtell, Lipton, Rosen & Katz.

Spier, an economist by training, joined the HLS faculty in 2007 as part of the efforts of then-Dean Elena Kagan ’86 to broaden the faculty and offer students a different perspective on the practice of law.

As Spier explains, “While the class is not building on law per se, it introduces students to an important and different facet of a client’s needs.” Since many clients come from a business school background, the course also offers HLS students a “common language.” Students also learn how to structure settlements and other types of “creative contracting,” agreements to help clients position themselves for success, she says.

Business Strategy for Lawyers, which enrolls about 50 students each year, is also helpful for students who someday will be managing law firms, she says, since it covers such topics as how to structure incentives.

The course focuses on the management of pharmaceutical companies and major manufacturers, among other businesses. “It helps [students] understand their clients’ needs and also the motivation of their clients’ adversaries, so they’re getting a fuller picture of the business landscape,” Spier says.

A Concrete Way of Looking at the Law

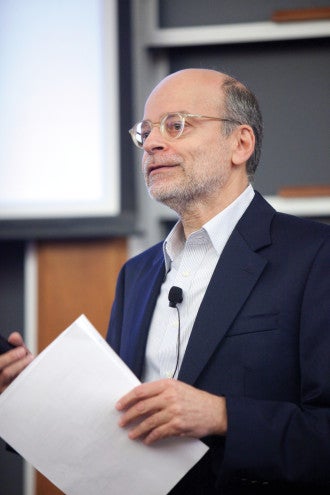

Professor Mark Roe ’75

Bankruptcy

Mark Roe’s course on bankruptcy emphasizes how business transactions are structured in light of bankruptcy law. Students get to focus during several weeks on a typical bond agreement to determine how its key parts would fare under bankruptcy court decisions and the bankruptcy statute.

“It’s a concrete way of looking at the law,” says Roe, who launched the approach after realizing that too many traditional bankruptcy courses didn’t address enough of what business lawyers do in the financing transactions that anticipate a bankruptcy. Many HLS students would benefit from this approach, he concluded—to see how bankruptcy affects financing decisions, planning, and structures, and to spend more time decoding transactional complexity in law school, rather than on the job.

His course has included visits from prominent bankruptcy lawyers to discuss the most current, and often most controversial, transactions and bankruptcy proceedings. And, since most bankruptcy matters are settled rather than litigated, toward the end of the semester, he has students break up into groups and negotiate a plan of reorganization in bankruptcy.

Roe introduced these aspects because, he says, “many HLS students who become business lawyers will deal with bankruptcy in complex financing transactions, and I had the sense that we could do better in getting students ready for that by imparting more finance and business skills and background.” Reading and parsing appellate decisions and doctrines are important skills, he believes, but reading the bankruptcy statute in light of a proposed transaction is just as important and can get neglected in casebooks that focus on appellate decisions and statutory construction. “The transaction … and not the appellate brief is more often how our graduates will bump into bankruptcy,” he adds.