People

Mark Wu

-

Battle of the ban: TikTok fight is just getting started

March 15, 2024

This week’s congressional crackdown on the Chinese-owned social network TikTok is only the beginning. A bill passed overwhelmingly by the US House on Wednesday would…

-

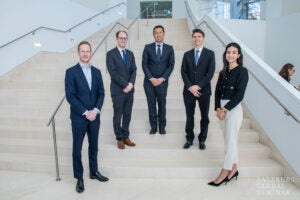

2024 Salzburg Cutler Fellows explore international law in times of great power competition

February 22, 2024

Four Harvard Law School students were selected this year as Salzburg Cutler Fellows. This annual program brings together students from 14 leading U.S. law schools to foster skills and forge connections through their common interest in international law.

-

Fact-Checking Haley and DeSantis in Their Race to Rival Trump

November 15, 2023

Nikki Haley, a former governor of South Carolina, and Gov. Ron DeSantis of Florida are vying to dethrone the Republican Party’s clear presidential front-runner, Donald…

-

Alice Hu has been elected president of the National Asian Pacific American Law Student Association, an organization founded in 1981 to represent and support Asian Pacific American law students.

-

Four Harvard Law School students were selected this year as Salzburg Cutler Fellows in International Law and Public Service.

-

Why you should care about the Chinese spy balloon

February 8, 2023

After the U.S. military shot down a Chinese surveillance balloon that had been hovering over the country for nearly a week, tensions remain between the…

-

Harvard Law School welcomes the LL.M. Class of 2021 to campus

November 2, 2022

Dean John F. Manning ’85 invited members of the LL.M. Class of 2021, whose LL.M. year was entirely virtual, to experience life on campus and connect with each other in person.

-

Russia’s invasion of Ukraine is an existential crisis, says European Commission trade leader

October 19, 2022

Russia’s war in Ukraine is both a threat to democratic values and an opportunity for global leadership, said European Commission Executive Vice President Valdis Dombrovskis, speaking to an audience of students and faculty at Harvard Law School.

-

‘Democracy and open society, human dignity, doesn’t necessarily win — we have to work for it’

April 13, 2022

The Harvard International Law Journal recently hosted a discussion with Stavros Lambrinidis, ambassador of the European Union to the United States.

-

North Dakota’s State Investment Board Gives The Green Light to Stop Investing in Russia

March 8, 2022

After getting enormous pressure from the public, as well as from members of both side of the isle in North Dakota, in the wake of Russia’s invasion of Ukraine, the State Investment Board convened a special meeting Thursday to discuss divesting its Russian holdings. During executive session, the SIB voted unanimously to pursue the divestment strategy. ... News Radio reached out to Harvard Professor Mark Wu on any implications that SB 2291 could have in the process. “The decision at hand concerns divestment, as opposed to investment. While the state law places restrictions on the State Investment Board’s investment decisions, it does not place similar restrictions on its divestment decisions.” Professor Wu continued, “What this means practically is that the state investment board could take geopolitical considerations into account for a divestment decision, but should it then decide to divest, the existing law would place restrictions on what the board can and cannot do in deciding how to re-invest the proceeds of the divestment.” Professor Wu is the Henry L. Stimson Professor at Harvard Law School, where he specializes in international trade and international economic law.

-

When Nixon went to China

February 17, 2022

On the 50th anniversary of President Nixon's visit, China experts William Alford and Mark Wu discuss whether the president may be getting too much credit for his history-making journey.

-

Katherine Tai represents

July 23, 2021

In her new role as U.S. trade representative, Tai ’01 brings legal expertise, political savvy, and a deep commitment to American workers.

-

Salzburg Cutler Fellows forge online connections

May 18, 2021

The ninth annual Salzburg Cutler Fellows Program brought together 53 law students from across the U.S., including four from Harvard Law School, to explore the future of public and private international law.

-

Since President Joe Biden took office in January, dozens of Harvard Law community members, including faculty and alumni, have been tapped to serve in high-profile positions in his administration

-

Sharing stress strategies

October 14, 2020

For ABA Mental Health Day, five faculty share struggles from their own law school days and offer options for coping and support.

-

Death of trade deal with China could be ‘October surprise’

September 14, 2020

On Tuesday, Danny Diaz, who ran former Florida Gov. Jeb Bush’s ill-fated 2016 presidential campaign, told POLITICO’s Tim Alberta that if there’s an “October surprise” in this election, “it’s something abroad. It’s a foreign policy-oriented development.” We asked the experts: if it’s China-related, what might it look like? A Phase One trade deal collapse is the most likely China-related event to upend the U.S. election. Harvard Law School’s Mark Wu says President Donald Trump could declare China “off track in meeting the purchase commitments.” Eurasia Group’s Paul Triolo says Trump “has become progressively less interested in the trade deal,” while E14 Fund’s Calvin Chin says ditching the deal is the “easiest to pull off [with] good electoral bang for the buck.” The Bay Area Economic Council’s Sean Randolph tells China Watcher that “while this might look like a failure at one level, Trump could try to show that he's in control, tough on China, and looking out for U.S. interests.” The deal would be (bureaucratically) easy to unwind, according to Asia Society’s Wendy Cutler. “Legally, the agreement requires a 60-day advance notification period before withdrawal,” she tells China Watcher, “but as we’ve seen to date the legalities would be overshadowed by a surprise announcement.” Trump can get the electoral pop from an announcement his administration intends to leave, even if it’s not official until after the election. U.S. and Chinese multinational companies could be frozen out. Heritage Foundation’s Klon Kitchen says China could block a TikTok sale and possibly remove “one or several industry leaders” among U.S. tech companies in China. Schmidt Futures’ Christopher Kirchhoff says Chinese ruler Xi Jinping could “move to ban Apple products in China.” Syracuse University’s Mary Lovely says a Trump move against WeChat could see Beijing retaliating against U.S. firms in China.

-

Making lemonade from lemons

September 1, 2020

When the coronavirus pandemic handed him lemons, Stefan Martinić LL.M. ’21 made lemonade—literally—and invited his Harvard Law School LL.M. classmates around the globe to join him for an online lemonade party, sparking the class to create a variety of virtual social events that have already bonded them closely.