Make a world of difference with a gift from your IRA

- If you are 70.5 years+, you can use up to $55,000 from your IRA as a one-time gift to HLS for a charitable gift annuity, which will pay you and another if included, an income for your lifetimes.

- The annuity would pay you an annual amount equal to a percentage based on your age(s) applied to the gift amount of $55,000. A 75-year-old would receive 7.2% of $55,000, which equals $3,960, and is paid in quarterly installments.

- If you are married, you and your spouse can each contribute up to $55,000 from separately owned IRAs for a total of $110,000; your annuity rate would be based on both of your birthdates.

- The gift can count toward your minimum distribution.

A smart annual gift, a special one-time option.

Consider the benefits:

- Your gift makes an immediate impact at HLS.

- Although there is no tax deduction, the amount transferred is excluded from your income for federal tax purposes—no tax is due.

- Transfers up to $110,000 (annual aggregate limit) qualify for this favorable tax treatment each year. (Contributions to an IRA after age 70.5 reduce QCD amounts).

- Qualified charitable distributions can count toward your required minimum distribution.

- If you are celebrating a reunion, a gift from your IRA can be included in your Class Gift and can also be used to make a pledge payment.

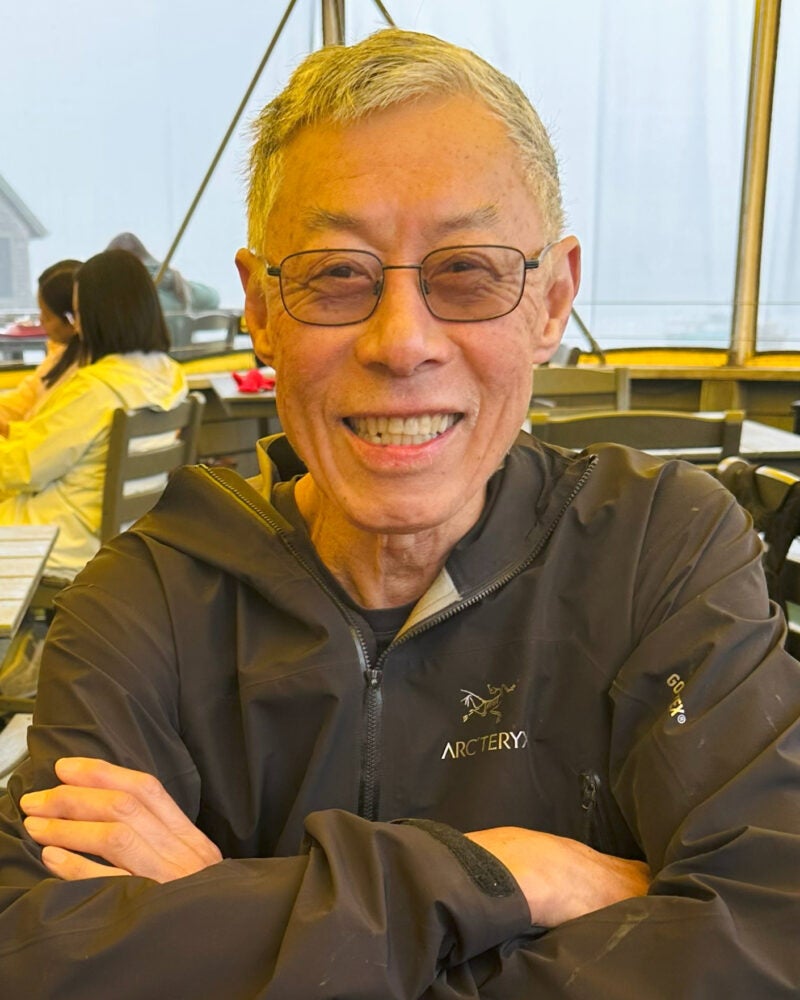

“I have been giving to HLS through IRA charitable rollovers since I turned 70½ (previously, I made regular charitable contributions). I have long felt indebted to the school: for the quality of the education; for the tuition grants extended to me; and, looking back some 60 years, for a wonderfully stimulating three years. For this to continue for future generations, HLS needs strong support from alumni. Considering the tax advantages, donations via an IRA charitable rollover are an easy decision for those who qualify.”

– Gerald Sun LL.B. ’68

How to make an IRA gift

To make your gift, instruct your IRA custodian to make a direct transfer from your IRA account to:

Harvard Law School

1563 Massachusetts Avenue

Cambridge, MA 02138

Attn: HLS Donor Services

Development and Alumni Relations